As global markets face unprecedented volatility, the "traditional" accounting model—characterized by reactive reporting, manual data entry, and siloed information—is no longer sufficient to support the speed of modern commerce. Advanced accounting solutions refer to the integration of cloud computing, artificial intelligence (AI), and automated workflows into a unified financial ecosystem. This shift is not merely technological; it is a fundamental re-engineering of the corporate "nervous system". For clients of Erphub, understanding this transition is the first step toward achieving Fiscal Orchestration — a state where financial data flows seamlessly between sales, inventory, and executive decision-making. The 2025 landscape is defined by the "Continuous Close." Modern enterprises no longer wait for the end of a fiscal quarter to understand their health. Cloud Accounting, as pioneered by Zoho, allows for a real-time, 360-degree view of financial status. According to recent industry reports, firms with over $7% cloud integration achieved $12% higher revenue growth compared to their peers stuck in legacy environments. Governments worldwide are shifting toward E-Invoicing and real-time reporting (e.g., GST in India, VAT in the UK/EU, and Sales Tax in North America). Additionally, Environmental, Social, and Governance (ESG) reporting is becoming mandatory, requiring accounting systems to track non-financial metrics (like carbon offsets) alongside dollars.

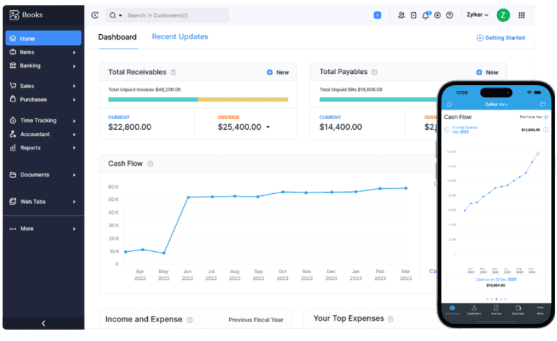

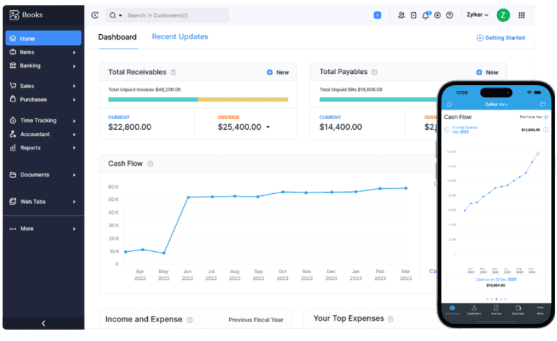

Zoho Books: The Core Intelligent Ledger

Zoho Books is a comprehensive double-entry accounting software that serves as the "Single Source of Truth."

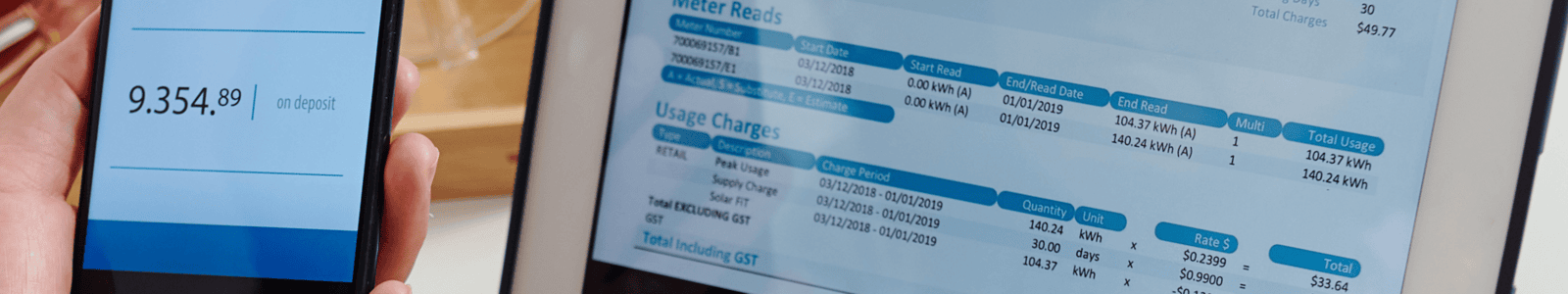

Bank Reconciliation: Using AI-powered Zia, Zoho Books fetches bank feeds and auto-matches transactions with an accuracy rate exceeding those manually.

Workflow Blueprints: Managers can set up strict approval flows, ensuring that no expense over a certain threshold is processed without multiple sign-offs.

Feature | Impact on Business Growth | Strategic ROI |

Real-Time Dashboards | Immediate visibility into cash flow and burn rate. | $26\%$ faster growth via agile decision-making. |

Automated Payment Reminders | Reduces Days Sales Outstanding (DSO). | Improved liquidity and working capital. |

Multi-Currency Support | Automatic exchange rate updates and gain/loss tracking. | Seamless global expansion without manual forex. |

Beyond basic bookkeeping, the Zoho Finance Plus suite orchestrates the entire "Quote-to-Cash" lifecycle.

Zoho Inventory: Synchronizes stock levels across multiple warehouses. When an item sells, it instantly updates the balance sheet in Zoho Books.

Zoho Expense: Automates employee reimbursements using OCR (Optical Character Recognition) to scan receipts, eliminating the need for manual expense reports.

Zoho Billing (Subscriptions): Perfect for the modern "Subscription Economy," handling recurring revenue, trial periods, and prorated billing automatically.

Zoho Payroll: Ensures tax-compliant salary disbursements, integrated directly with the general ledger.

A streamlined accounting system in 2025 is not just "automated"; it is "intelligent." Zoho's AI assistant, Zia, provides capabilities that were previously reserved for Fortune 500 companies with massive data science teams. Zia monitors financial patterns to detect potential fraud or human error. If a vendor suddenly submits a bill for twice the usual amount, or if a transaction occurs at an unusual time, Zia flags it for review. This has been shown to increase fraud detection capacity by $8% [Source: McKinsey AI Trends 2025]. By analyzing historical data, Zoho can predict your cash position for the next six months. This allows Erphub clients to time their capital expenditures (CapEx) perfectly—knowing exactly when they will have a surplus and when to tighten the belt. In an era of sophisticated cyber-attacks, the "worth" of an accounting solution is also measured by its security posture. Zoho operates on a Zero-Trust architecture, providing:

Role-Based Access Control (RBAC): Restricts data visibility so employees see only what they need.

Audit Trails: A permanent, uneditable record of who changed what, when, and from where—a critical requirement for GAAP and IFRS compliance.

Encryption: Data is encrypted at rest and in transit using bank-grade protocols.

Choosing the right software is only half the battle; the "Streamlining" happens during implementation. This is where Erphub provides its unique value. Moving from legacy systems (like QuickBooks Desktop or Sage) to Zoho requires a multi-step approach:

Data Hygiene Audit: Cleaning historical data before migration.

Custom Workflow Mapping: Tailoring Zoho’s modules to match your specific industry (e.g., construction vs. e-commerce).

Integration Architecture: Connecting Zoho to your existing CRM, POS, or specialized manufacturing software.