Winning Subscription business with Zoho Payments

Key Drivers Propelling the Subscription Model:

- Predictable Revenue Streams: Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) provide financial stability and predictability, crucial for planning and investment.

- Enhanced Customer Lifetime Value (LTV): Ongoing relationships foster loyalty and create opportunities for upselling and cross-selling, significantly increasing the total value derived from each customer.

- Deeper Customer Relationships: Continuous engagement allows businesses to gather more data, understand customer needs better, and personalize offerings, leading to stickier relationships.

- Scalability: Digital delivery and automated billing systems enable subscription businesses to scale more efficiently than those reliant on physical goods or one-off transactions.

- Market Demand: Consumers and businesses alike increasingly prefer access over ownership, valuing flexibility, convenience, and continuous improvement.

This isn't merely a trend, it is a structural change in commerce, compelling businesses to rethink their entire go-to-market strategy and operational backbone.

User-Centric Payment Models: Flexibility Meets Value

Beyond blanket subscriptions, there's a growing demand for payment models that align more closely with actual usage or perceived value. These user-centric models empower customers and can significantly broaden market appeal.

- Usage-Based/Metered Billing: Customers pay only for what they consume (e.g., data storage, API calls, hours of service). This model is highly transparent and ensures customers feel they are getting fair value. It's prevalent in cloud services (IaaS, PaaS) and increasingly in other sectors.

- Tiered Pricing: Offering multiple subscription levels with varying features, limits, or service levels allows businesses to cater to different customer segments and budgets, facilitating easier entry and clear upgrade paths.

- Freemium-to-Premium: Providing a basic version of a product or service for free, with the option to upgrade for advanced features, is a powerful customer acquisition strategy, particularly in software and digital content.

- Pay-As-You-Go (PAYG): Similar to usage-based but often implies more ad-hoc consumption without a formal recurring commitment for some services.

These models require sophisticated tracking and billing capabilities to manage variable invoicing accurately and efficiently.

Affiliate Marketing as a Scalable, Performance-Driven Revenue Channel

Affiliate marketing has matured into a highly effective and scalable channel for customer acquisition and revenue generation. Businesses partner with affiliates (individuals or other companies) who promote their products or services in exchange for a commission on sales or leads generated.

- Low Upfront Cost: It's a performance-based model; you only pay for actual results, making it highly cost-effective compared to traditional advertising.

- Broadened Reach: Affiliates can tap into niche audiences and markets that a business might not reach directly.

- Credibility and Trust: Recommendations from trusted affiliates can carry more weight than direct advertising.

- Measurable ROI: With proper tracking, the return on investment from affiliate marketing is highly measurable.

The global affiliate marketing industry is valued in the tens of billions of dollars and continues to grow, as highlighted by industry resources like Affiliate Summit and various market research reports. Effective management of affiliate programs, from tracking referrals to calculating and disbursing commissions, is crucial for success and requires robust systems.

The Inherent Challenges in Managing Complex Revenue Models Manually or with Disparate Systems

While dynamic subscriptions, user-centric payments, and affiliate programs offer immense revenue potential, managing them effectively presents significant operational challenges if approached with outdated or fragmented tools:

- Billing Complexity: Calculating prorated charges, usage fees, tiered pricing, promotional discounts, and affiliate commissions manually is error-prone and time-consuming.

- Data Silos: Customer information, subscription details, payment histories, and affiliate performance data residing in separate systems hinder a unified view of the customer and revenue operations.

- Revenue Leakage: Errors in billing, failed payments, unmanaged dunning, and inaccurate commission payouts can lead to significant lost revenue.

- Poor Customer Experience: Inconsistent billing, difficulty in managing subscriptions, or payment processing issues can lead to customer frustration and churn.

- Scalability Issues: Manual processes and disparate systems simply cannot scale as the customer base and transaction volume grow.

- Compliance Risks: Adherence to payment security standards (PCI DSS), tax regulations, and revenue recognition rules becomes increasingly difficult.

- Lack of Actionable Insights: Without integrated data, deriving meaningful analytics on MRR, churn, LTV, or affiliate ROI is a major struggle.

As detailed by consulting firms like McKinsey and Deloitte in their analyses of digital transformation and business model innovation, the backbone technology for managing these revenue streams is a critical success factor. The concept of a "subscription" has evolved far beyond the traditional fixed monthly fee for a magazine. Today, dynamic subscriptions represent a sophisticated and flexible approach to recurring revenue, characterized by their ability to adapt to customer usage, preferences, and evolving value perception. They are the lifeblood of many modern digital businesses and an increasingly attractive model for service providers across various sectors. Mastering dynamic subscriptions is key to building predictable revenue streams while fostering strong, long-term customer relationships. Dynamic subscriptions move beyond simple, static recurring payments. They encompass a variety of flexible billing models designed to align the cost of a service or product more closely with the value received by the customer.

Successfully navigating these pitfalls requires a sophisticated and integrated subscription management platform. This is where a comprehensive solution like Zoho Subscriptions, often working in concert with Zoho CRM and other Zoho finance tools, becomes indispensable for businesses aiming to implement and scale dynamic subscription models effectively. The subsequent sections will delve into how Zoho's ecosystem specifically addresses these needs and empowers businesses to harness the full potential of dynamic recurring revenue. For US businesses considering this journey, expert guidance from a Zoho partner like Erphub can be instrumental in designing and implementing a robust and scalable subscription management infrastructure.

Benefits for Small & Medium Scale Businesses and Enterprises

For businesses ready to embrace the dynamic subscription economy, choosing the right technology backbone is paramount. The Zoho ecosystem, particularly Zoho Subscriptions integrated within the broader Zoho One or Zoho Finance Plus suite, offers a comprehensive and powerful solution designed to handle the complexities of modern recurring billing with agility and precision. This section will provide a deep dive into how Zoho empowers businesses to not just manage, but truly master dynamic subscription models for sustained revenue growth.

Overview of Zoho One / Zoho Finance Plus as a Unified Platform for Revenue Operations

Before zooming into Zoho Subscriptions, it's crucial to understand its context within Zoho's larger vision. Zoho One is an all-in-one suite of over 45 integrated applications covering nearly every business function, from sales (CRM) and marketing to finance, HR, and operations. Zoho Finance Plus is a more focused suite specifically designed for financial operations, including invoicing, accounting, expense management, inventory, and, critically, subscription management.

The power of this unified approach cannot be overstated for revenue operations:

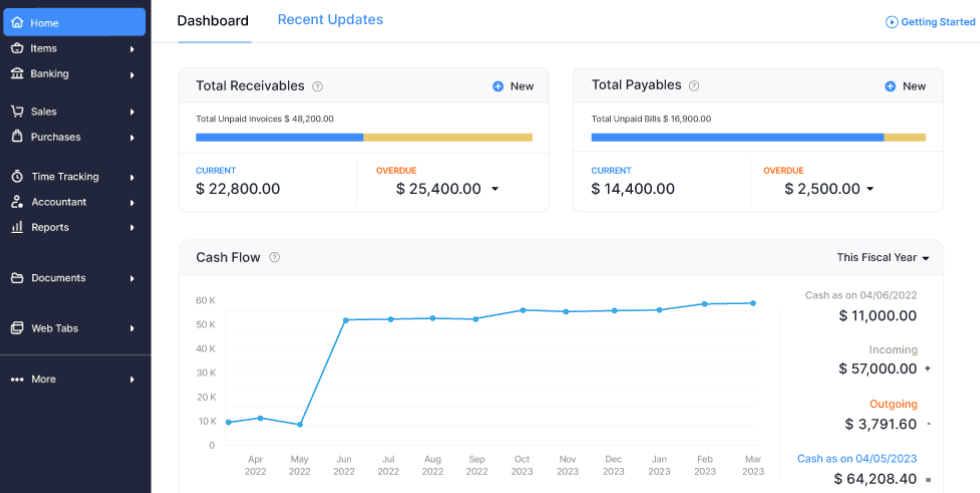

- Seamless Data Flow: Customer data from Zoho CRM, transaction data from Zoho Subscriptions, and financial data from Zoho Books flow seamlessly, providing a 360-degree view without manual data entry or clunky integrations.

- End-to-End Process Automation: Workflows can be automated across applications – for example, a new deal closed in Zoho CRM can automatically trigger a subscription creation in Zoho Subscriptions and an initial invoice in Zoho Books.

- Consistent User Experience: A familiar interface across applications reduces the learning curve and improves user adoption.

- Cost-Effectiveness: Compared to licensing multiple disparate best-of-breed applications, Zoho's bundled suites often offer significant cost advantages.

This integrated environment provides the ideal foundation for managing complex, dynamic subscription lifecycles effectively.

Zoho Subscriptions: Deep Dive into its Core Capabilities

Zoho Subscriptions is the flagship application within the Zoho suite specifically engineered for end-to-end subscription lifecycle management. It's designed to automate recurring billing, manage customer subscriptions, analyze key metrics, and reduce churn.

Core Features Driving Dynamic Revenue Models:

- Flexible Plan Management: Businesses can create and manage an unlimited number of subscription plans and add-ons. This includes defining pricing, billing frequencies (daily, weekly, monthly, yearly), free trial periods, and setup fees. For example, a SaaS company could offer "Basic," "Pro," and "Enterprise" plans, each with different feature sets and user limits, and also offer an optional "Premium Support" add-on for an additional monthly fee. Zoho Subscriptions handles the separate billing cycles and bundling logic effortlessly.

- Automated Recurring Billing & Invoicing: Once a customer subscribes, Zoho Subscriptions automates the entire billing process, from generating invoices on schedule to charging the customer's chosen payment method. This eliminates manual effort and ensures timely revenue collection. The system automatically sends professional, customizable invoices reflecting the current plan, any add-ons, and applicable taxes.

- Proration and Mid-Cycle Changes: One of the hallmarks of dynamic subscriptions is allowing customers to upgrade, downgrade, or change their plans at any time. Zoho Subscriptions automatically calculates prorated charges or credits accurately, ensuring fair billing and a smooth customer experience. If a customer on a $50/month plan upgrades to a $100/month plan halfway through the billing cycle, Zoho Subscriptions will correctly charge them for the unused portion of the old plan and the remaining portion of the new plan, reflected transparently on their next invoice.

- Trial Management: Businesses can easily offer free or paid trial periods. Zoho Subscriptions automates the conversion from trial to paid subscription if the customer chooses to continue, or manages the expiration of the trial. It can also send automated reminders before a trial ends to encourage conversion.

- Coupon and Discount Management: Creating and managing promotional codes, percentage-based discounts, or fixed-amount discounts for specific plans or customer segments is straightforward. This is vital for marketing campaigns and customer acquisition.

- Hosted Payment Pages: Secure, PCI-compliant, and customizable hosted pages for customers to sign up for subscriptions and enter their payment details, reducing the business's PCI compliance burden.

Handling Metered and Usage-Based Billing with Precision: Zoho Subscriptions provides robust capabilities for businesses whose pricing depends on actual consumption.

- Defining Metered Components: Businesses can define specific "metered components" or "billable units" within their subscription plans (e.g., API calls, data storage in GB, minutes used, users activated).

- Usage Tracking and Reporting: Usage data can be reported to Zoho Subscriptions either manually, via CSV import, or programmatically through its APIs. This allows for real-time or periodic updates of consumption. For instance, an IoT platform can push data on device activity daily, and Zoho Subscriptions will aggregate this usage for monthly billing.

- Automated Usage-Based Invoicing: At the end of each billing cycle, Zoho Subscriptions automatically calculates charges based on the recorded usage against the defined rates for each metered component, adding it to the base subscription fee if applicable. This ensures accuracy and eliminates manual calculations for complex usage patterns.

While subscriptions form the core of recurring revenue, managing one-time payments, setup fees, ad-hoc purchases, or even the collection of initial subscription payments requires a robust, flexible, and secure user payment system. Zoho provides a suite of tools designed to make payment collection frictionless for customers and efficient for businesses, directly impacting conversion rates and cash flow. Zoho's payment tools are designed with security at their core. By integrating with PCI DSS compliant payment gateways and using features like hosted payment pages, Zoho helps businesses reduce their PCI compliance scope and assure customers that their payment data is handled securely. Zoho's finance suite allows for efficient processing of refunds. While dispute and chargeback management primarily happens at the payment gateway level, Zoho's transaction records provide essential documentation for these processes.

Affiliate marketing offers a potent, performance-based channel to acquire new customers and drive significant revenue growth with relatively low upfront costs. However, managing an affiliate program – from tracking referrals and calculating commissions to processing payouts – can be complex. While Zoho doesn't have a dedicated, standalone "Zoho Affiliate" application in the same vein as Zoho Subscriptions, its ecosystem of flexible tools like Zoho CRM, Zoho Creator, and integrations allows businesses to build and manage effective affiliate billing systems. Manual tracking is prone to errors. Ensuring accurate attribution across multiple touchpoints can be difficult. Managing diverse commission structures and payout schedules for many affiliates can become an administrative nightmare. Fraud prevention is also a concern. The true differentiating strength of Zoho lies not just in the individual capabilities of its applications, but in their seamless integration to create a holistic Revenue Operations (RevOps) ecosystem. This unified approach breaks down traditional silos between sales, marketing, customer success, and finance, enabling businesses to manage the entire revenue lifecycle with unprecedented efficiency, visibility, and intelligence.

Successfully deploying Zoho's powerful suite for dynamic subscriptions, user payments, and affiliate billing is more than just a software setup; it's a strategic business transformation initiative. A methodical implementation approach, ideally guided by experienced Zoho consultants like Erphub, is crucial for maximizing ROI and avoiding common pitfalls. Once a robust Zoho foundation for dynamic subscriptions, user payments, and affiliate billing is in place, businesses can explore more advanced strategies to further optimize revenue, enhance customer experiences, and future-proof their operations. The Zoho ecosystem, with its ongoing innovation, provides fertile ground for these advanced applications. The journey from traditional, static sales models to dynamic, recurring, and performance-driven revenue streams is a defining characteristic of successful modern businesses. Architecting and managing dynamic subscriptions, seamless user payments, and scalable affiliate billing programs presents considerable complexity, yet the rewards—predictable growth, enhanced customer lifetime value, and market agility—are transformative.