The digital economy has fundamentally reshaped the operational dynamics of businesses, rendering traditional, siloed financial tools increasingly insufficient. Modern enterprises, particularly small to medium-sized businesses (SMBs), burgeoning e-commerce ventures, agile marketing agencies, and expansive affiliate networks, now contend with an escalating complexity in managing diverse revenue streams, navigating global expenditures, and cultivating intricate stakeholder relationships. This evolving environment mandates a strategic departure from disparate financial tools towards integrated solutions that offer a holistic perspective and centralized control over all financial processes. The conventional business banking model, while serving as a foundational pillar for transactional services, often operates in a reactive capacity, lacking the deep integration into operational workflows necessary for contemporary business demands.

The pervasive shift towards a digital-first imperative is a primary driver behind this transformation. The exponential growth of e-commerce and the widespread adoption of mobile payments signify a fundamental re-engineering of business operations. Traditional banking systems, primarily conceived for physical transactions, struggle to keep pace with the velocity and volume of digital commerce. An integrated platform represents a natural and necessary evolution, as it centralizes digital financial data, automates repetitive processes, and delivers real-time insights, all of which are paramount for digitally-native businesses. This inherent need for digital integration extends beyond mere payment acceptance, encompassing the entire financial workflow to ensure seamless operations and accurate reporting.

The Imperative of Comprehensive Payment Management for Growth and Efficiency

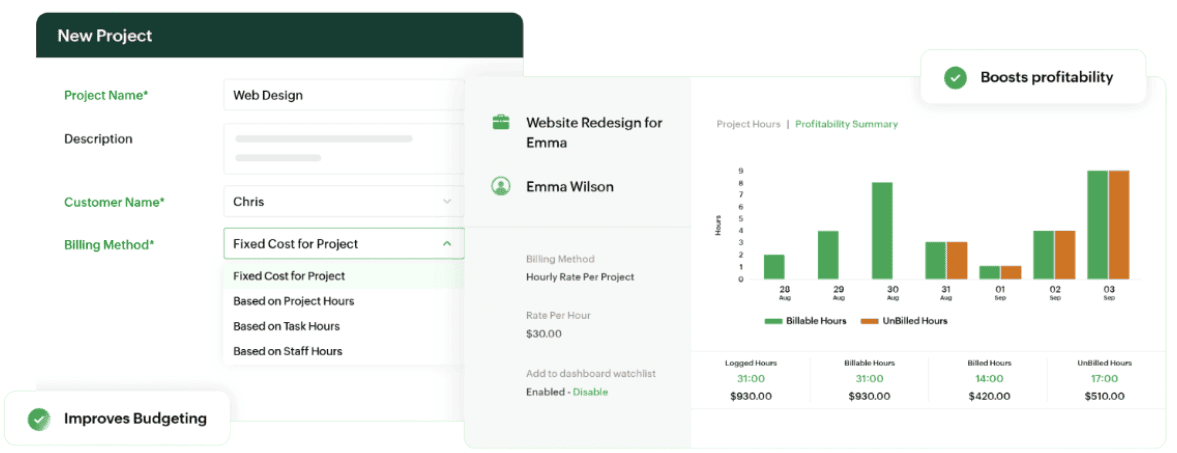

For businesses committed to achieving scalable growth, basic banking functionalities are no longer adequate. The modern enterprise demands a robust payment management system that not only facilitates a wide array of transactions but also integrates deeply with core business operations. This profound integration is indispensable for maintaining robust cash flow, optimizing expenditures across diverse categories, managing complex vendor and affiliate relationships with precision, and streamlining customer billing processes from initiation to reconciliation. Such a comprehensive solution transcends the mere processing of payments; it actively contributes to strategic decision-making, mitigates financial risks, and cultivates unparalleled financial clarity. This allows businesses to transform raw financial data into actionable intelligence, enabling them to adapt swiftly to market dynamics and capitalize on emerging opportunities. Indeed, studies indicate that businesses leveraging such integrated approaches can achieve significant improvements in financial process efficiency and a substantial reduction in reconciliation times.

While the initial impetus for adopting integrated platforms and outsourcing often stems from the pursuit of cost reduction , the more profound value resides in the capacity for strategic resource reallocation. By delegating routine financial tasks to an integrated platform, organizations can liberate their internal teams from the burden of "non-core tasks". This liberation of valuable time and human capital enables the in-house team to concentrate on strategic initiatives that directly drive growth, such as product development, customer acquisition, and fostering innovation. This strategic redirection of resources, rather than solely focusing on cost containment, emerges as a significant competitive advantage, paving the way for accelerated growth and a more resilient business model.

The unification of payment and business operations, often facilitated by robust ERP integration, is not merely a matter of operational efficiency but fundamentally establishes a single, reliable source of truth for all financial data. Fragmented financial data, dispersed across disparate systems, inevitably leads to inaccuracies, delays, and a critical lack of holistic visibility. A comprehensive platform, by centralizing this information, enables real-time reporting and advanced analytics. This immediate and accurate data serves as the bedrock for informed strategic decision-making, empowering businesses to identify emerging trends, anticipate potential challenges, and seize opportunities far more effectively than competitors relying on outdated or incomplete financial intelligence.

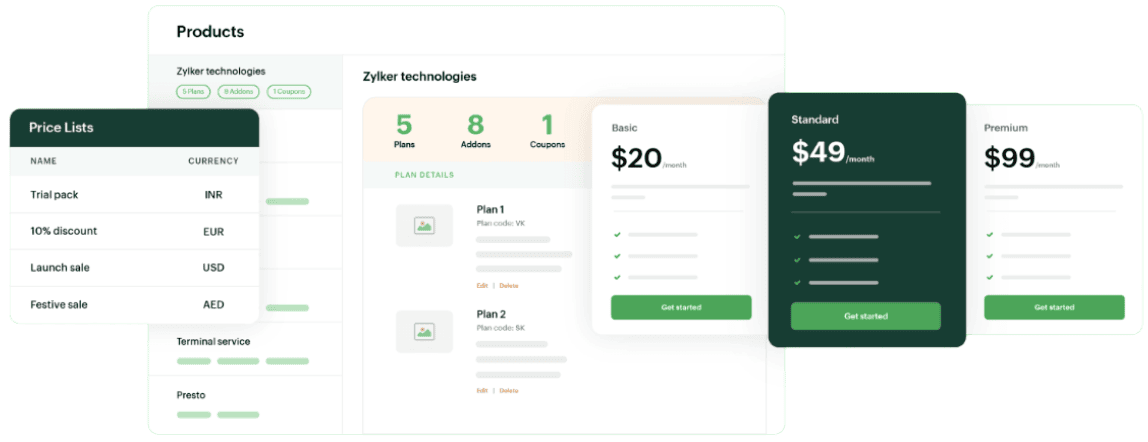

Automation and Intelligence in Pricing Execution

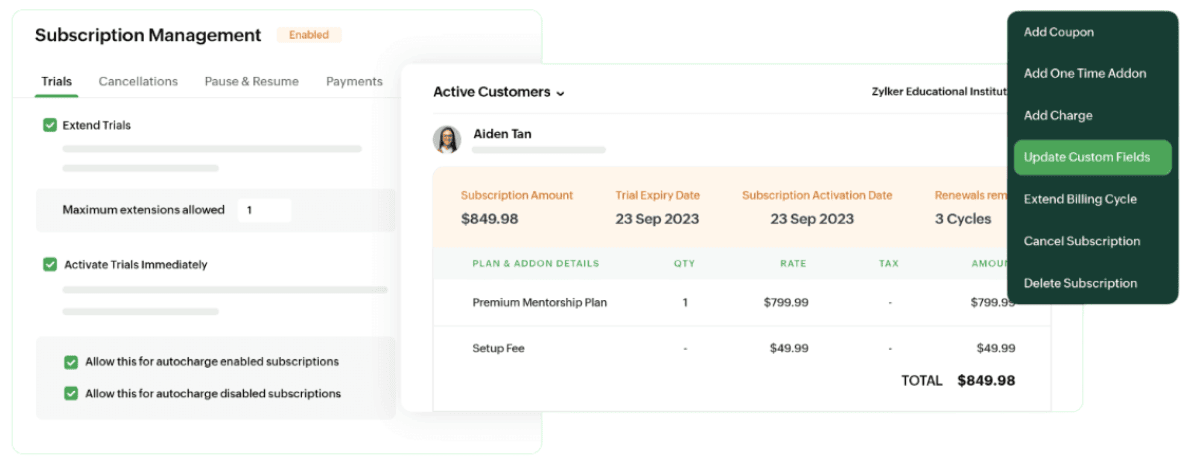

Effective implementation of dynamic pricing necessitates robust automation and intelligent systems. Manual adjustments are inherently impractical for businesses characterized by high transaction volumes or intricate pricing structures. Advanced payment platforms automate the precise calculation and application of charges based on predefined rules, real-time usage data, or specific promotional triggers. This automation minimizes the incidence of human error, significantly accelerates billing cycles, and ensures the consistent application of established pricing policies. Moreover, integrated analytics provide real-time insights into the performance of various pricing strategies, empowering businesses to rapidly test, refine, and optimize their approaches for maximum revenue generation.

Automated pricing execution, while primarily designed for efficiency, concurrently serves as a critical safeguard against compliance risks and billing inaccuracies. Manual calculation and application of complex pricing rules, intricate discounts, or escalating late fees are inherently susceptible to human error. Such errors can lead to revenue leakage, protracted customer disputes, and potential compliance infractions. By automating these processes through sophisticated custom functions and configurable workflow rules , the platform ensures the consistent and accurate application of all pricing logic. This not only boosts operational efficiency but also functions as a vital protective measure against financial discrepancies and potential regulatory non-compliance.

The integration of real-time analytics with pricing automation establishes a powerful feedback loop for continuous optimization. Automated systems execute predefined pricing strategies , but their efficacy demands constant monitoring and evaluation. Customizable reports detailing payment summaries, transaction histories, refunds, and payment failures yield invaluable insights into cash flow dynamics and emerging payment trends. This granular data, when synergistically combined with predictive analytics capabilities , enables businesses to meticulously assess the impact of their pricing models and iterate swiftly. This agile experimentation, driven by comprehensive data, ensures that pricing strategies remain optimally aligned with market conditions and responsive to shifts, thereby maximizing revenue outcomes.

The Strategic Imperative of Flexible Pricing Models

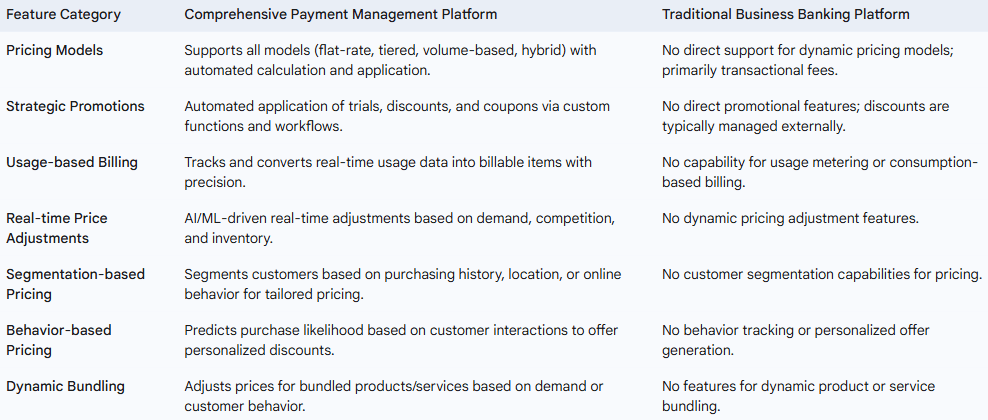

In today's intensely competitive markets, static pricing models are rapidly becoming obsolete. Businesses are compelled to adopt highly flexible and adaptive pricing strategies to respond effectively to market fluctuations, diverse customer segments, and evolving competitive pressures. Dynamic pricing, encompassing sophisticated models such as tiered, volume-based, and usage-based pricing, empowers businesses to maximize revenue by adjusting prices in real-time. This inherent agility is particularly critical for sectors like e-commerce, Software-as-a-Service (SaaS), and subscription-based enterprises that serve heterogeneous customer bases and offer varied product or service bundles. The capacity to tailor pricing based on intricate factors such as customer behavior, real-time demand, or targeted promotional strategies directly influences lead conversion rates and significantly enhances customer lifetime value.

The evolution of dynamic pricing from rudimentary adjustments to sophisticated, real-time, behavior-based models is intrinsically driven by advancements in Artificial Intelligence (AI) and machine learning. Traditional pricing adjustments are often manual, reactive, and incapable of processing the vast datasets required for optimal decision-making. However, the ability to precisely segment customers, deploy time-sensitive offers, or implement nuanced behavior-based pricing strategies necessitates rapid data processing and advanced predictive capabilities. AI and machine learning provide the analytical prowess to instantaneously analyze demand patterns, monitor competitor pricing, and interpret complex customer behavior , enabling automated, precise, and equitable price adjustments. This paradigm shift transforms pricing from a static, periodic review process into a continuous, adaptive strategy, directly impacting conversion rates and optimizing revenue generation.

Beyond the immediate goal of revenue optimization, flexible pricing models can profoundly enhance customer satisfaction and foster enduring loyalty. Offering tailored pricing, customized bundles, and strategic add-ons based on specific customer segments or observed behavior cultivates a perception of understanding and value for the customer. This personalized approach, coupled with flexible payment options and diverse billing intervals , significantly elevates the overall customer experience. In a fiercely competitive market, providing a seamless and personalized payment journey can serve as a potent differentiator, fostering deeper customer loyalty and substantially increasing customer lifetime value, rather than merely securing a single transaction.

By unifying dynamic pricing strategies, streamlining internal accounting workflows, optimizing vendor and affiliate relationships, providing granular control over all expenditures, and revolutionizing customer billing, these platforms deliver unparalleled operational efficiency, financial accuracy, and strategic insight. They transform raw financial data into actionable intelligence, empowering businesses to proactively manage cash flow, mitigate risks, and adapt swiftly to market dynamics. The inherent scalability, robust security measures, and seamless integration with broader ERP systems collectively future-proof a business's financial infrastructure, allowing leaders to focus intently on core growth initiatives rather than being encumbered by administrative burdens.

In an era where agility and data-driven decisions are the arbiters of success, choosing a financial solution that transcends basic banking functionalities is not merely an option but a strategic imperative. For businesses seeking to optimize their financial operations, achieve greater control, and drive sustainable growth, the path forward lies in embracing a comprehensive payment management platform. Such an integrated solution can profoundly transform financial operations, unlock new efficiencies, and empower any business to navigate the complexities of the modern economy with unwavering confidence.

By unifying dynamic pricing strategies, streamlining internal accounting workflows, optimizing vendor and affiliate relationships, providing granular control over all expenditures, and revolutionizing customer billing, these platforms deliver unparalleled operational efficiency, financial accuracy, and strategic insight. They transform raw financial data into actionable intelligence, empowering businesses to proactively manage cash flow, mitigate risks, and adapt swiftly to market dynamics. The inherent scalability, robust security measures, and seamless integration with broader ERP systems collectively future-proof a business's financial infrastructure, allowing leaders to focus intently on core growth initiatives rather than being encumbered by administrative burdens.

In an era where agility and data-driven decisions are the arbiters of success, choosing a financial solution that transcends basic banking functionalities is not merely an option but a strategic imperative. For businesses seeking to optimize their financial operations, achieve greater control, and drive sustainable growth, the path forward lies in embracing a comprehensive payment management platform. Such an integrated solution can profoundly transform financial operations, unlock new efficiencies, and empower any business to navigate the complexities of the modern economy with unwavering confidence.

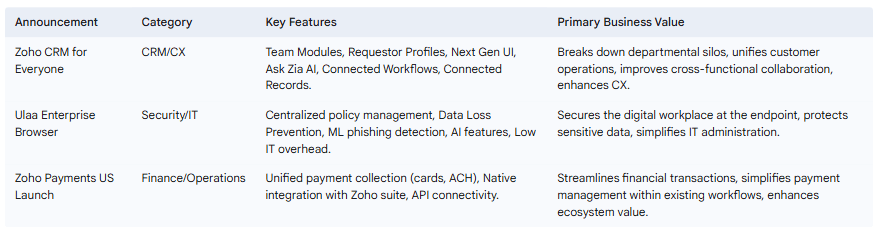

Key Announcements from Zoholics USA 2025 Day 1 (May 14th)

Day 1 Takeaways and the Path Forward

Day 1 of Zoholics USA 2025 in Houston delivered a clear and compelling vision for the future of business technology, centered firmly on the transformative power of AI and automation integrated across a unified platform. The keynotes set the stage by highlighting Zoho's strategic commitment to embedding AI deeply into its suite, positioning it as a fundamental layer for driving efficiency and enhancing decision-making.

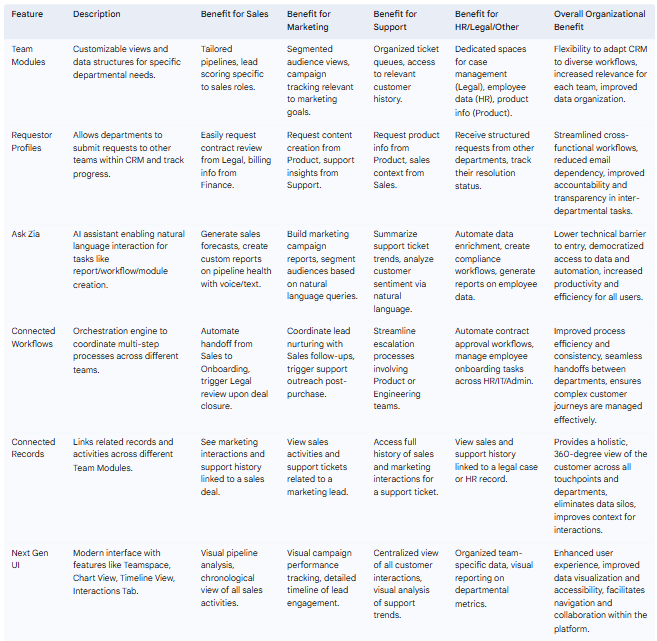

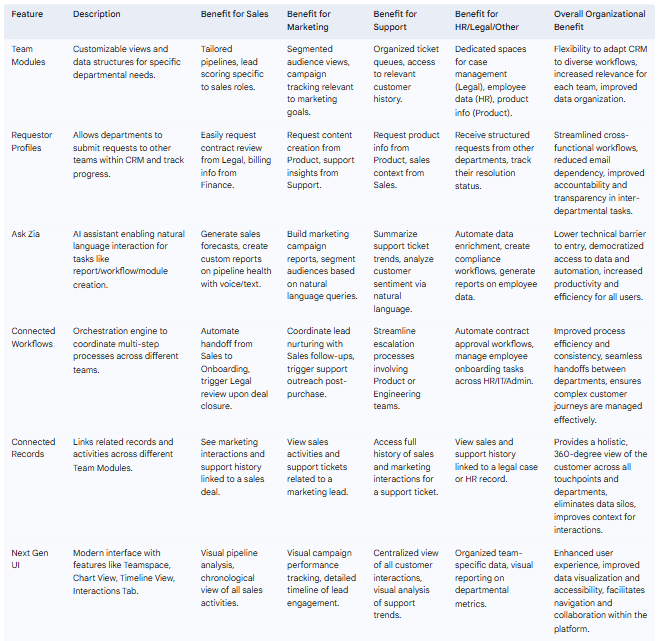

The major announcements from May 14th provided concrete examples of this strategy in action. The general availability of Zoho CRM for Everyone marked a significant step towards breaking down departmental silos and unifying customer operations across the entire enterprise, enabling better collaboration and a holistic view of the customer. The launch of Ulaa Enterprise demonstrated Zoho's focus on securing the digital workplace at the endpoint, addressing critical concerns around data privacy and IT management in distributed environments. The availability of Zoho Payments in the US streamlined financial transactions by integrating payment collection natively within the Zoho ecosystem.

These announcements, coupled with the pervasive emphasis on AI and automation across various solution tracks (CRM, Marketing, Finance, Operations, BI/Analytics, Collaboration), signaled Zoho's intent to move beyond being a provider of a suite of business applications to becoming the foundational "Operating System for Business" , with AI and unified data at its core. The combination of extending CRM to all departments, enhancing underlying security, and integrating core functions like payments natively, all powered by pervasive AI (Zia, Agentic AI), paints a picture of a platform aiming to manage and orchestrate nearly every aspect of a business. This strategic positioning is a direct response to the complexity and fragmentation businesses face with disparate systems and aligns with the need for a cohesive approach to digital transformation.

The focus on both high-level AI strategy, such as the discussions around Agentic AI, and granular feature enhancements across various applications indicated a mature product development approach that balances an ambitious future vision with practical, immediate improvements for users. Announcing both cutting-edge concepts like Agentic AI and tangible, usability-focused features shows Zoho is addressing different levels of user needs and technological maturity. This balanced approach makes the platform appealing to businesses looking for both immediate productivity gains and a clear path towards future innovation, building confidence that Zoho's AI vision is grounded in practical application and user value.

Day 1 of Zoholics USA 2025 showcased Zoho's commitment to providing businesses with the tools needed to navigate the complexities of the digital era, enhance efficiency through intelligent automation, and foster unprecedented growth through a unified, data-driven approach. The event underscored that successful business transformation in 2025 and beyond will heavily rely on leveraging integrated platforms infused with advanced AI capabilities to break down silos, empower teams, and deliver seamless customer experiences. The insights gained from Day 1 offer a clear roadmap for businesses seeking to harness the full potential of the Zoho ecosystem.