Core Features of Flexible Digital Payment Systems

A flexible digital payment system is largely dictated by the ability it has to adapt to evolving business needs, offering comprehensive features that cover a range of transactional processes. At its core, such a system supports multi-channel payment acceptance, allowing businesses to receive payments through credit cards, mobile wallets, online banking, and even cryptocurrencies. This adaptability reduces friction in the payment process, enabling seamless transactions that enhance customer satisfaction.

Flexible digital payment systems integrate features designed to enhance payment processing and customer management:

- Multi-Channel Payment Acceptance: Supporting card payments, e-wallets, and cryptocurrency options.

- Automated Billing and Invoicing: Simplifying transactions through real-time billing.

- Global Currency Support: Enabling cross-border transactions with minimal exchange rate risks.

- Security and Compliance: Providing fraud protection, encryption, and adherence to international standards.

Flexible digital payment systems integrate features designed to enhance payment processing and customer management:

- Multi-Channel Payment Acceptance: Supporting card payments, e-wallets, and cryptocurrency options.

- Automated Billing and Invoicing: Simplifying transactions through real-time billing.

- Global Currency Support: Enabling cross-border transactions with minimal exchange rate risks.

- Security and Compliance: Providing fraud protection, encryption, and adherence to international standards.

Technological Enablers

Technology solutions have played a pivotal role in shaping digital payment systems, enabling features that were once considered futuristic. Artificial intelligence (AI) and machine learning algorithms enhance fraud detection and automate customer service interactions, making payment systems more secure and user-friendly. For instance, AI-powered chatbots can guide users through complex payment processes while identifying suspicious activity through behavior analysis.

Digital payment platforms leverage technologies that drive efficiency and scalability:

- AI and Machine Learning: Enhancing fraud detection and personalized payment recommendations.

- Blockchain Technology: Ensuring secure, transparent, and tamper-proof transactions.

- APIs and Open Banking: Facilitating seamless integration with various financial services.

- AI and Machine Learning: Enhancing fraud detection and personalized payment recommendations.

- Blockchain Technology: Ensuring secure, transparent, and tamper-proof transactions.

- APIs and Open Banking: Facilitating seamless integration with various financial services.

Blockchain technology, known for its transparent and tamper-proof ledger system, has also revolutionized payment processing by enabling secure and verifiable transactions without intermediaries. This reduces costs and improves transaction speeds, making blockchain an appealing solution for businesses handling high-value or international transactions. Moreover, application programming interfaces (APIs) facilitate seamless integration with banking, accounting, and customer relationship management (CRM) platforms, allowing businesses to create tailored payment solutions.

Business Benefits

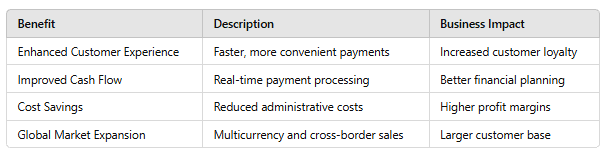

While some clear business benifits include aspects such as enhanced customer experience that enables faster checkouts, contactless payments, and mobile app integrations boost customer satisfaction and retention or , in context to 'business expansion and scalability, enabling payment systems integrated with CRM and ERP platforms like Zoho CRM enable better customer management and scalable operations and cost efficiency, which enables automated payments reduce manual processing costs, while lower transaction fees enhance profitability. The following table provides a summary onto that on conclusive aspects:

Implementing a digital payment system goes beyond simplifying transactions—it reshapes core business operations. One of the most significant benefits is improved cash flow management. By enabling real-time payment processing, businesses can access working capital faster, reducing liquidity risks and ensuring smoother financial operations. This immediacy is especially critical for small and medium-sized enterprises (SMEs), where cash flow issues can hinder expansion efforts.

Customer experience is another area that benefits significantly. Consumers today expect fast, seamless, and secure payment options, and businesses that deliver these experiences see higher customer satisfaction and retention rates. Personalized payment plans, loyalty rewards, and subscription billing are examples of how companies can use digital payment systems to strengthen customer relationships.

Additionally, businesses experience cost savings through reduced administrative expenses, thanks to automated invoicing and payment reconciliation. For global enterprises, digital payment systems enable market expansion by supporting multiple currencies and international payment methods. Companies can easily penetrate new markets, offering localized payment options that appeal to diverse customer bases. The scalability of these systems means businesses can adapt to fluctuating market demands without incurring prohibitive infrastructure costs.

Redefining Business Transactions in the Digital Era

The rapid digitization of global commerce has fundamentally changed how businesses operate, especially in managing transactions. Flexible digital payment systems have emerged as essential enablers of business growth by streamlining payment processes, improving customer experiences, and opening new market opportunities. These systems allow companies to accept payments across multiple channels while optimizing operations through automation and integration. For businesses aiming for sustainable growth, digital payment platforms represent more than a transactional tool—they are a strategic business asset that drives efficiency, customer engagement, and profitability.

Automation is another critical feature, especially when managing invoicing, payment reminders, and reconciliation processes. By integrating with accounting and enterprise resource planning (ERP) systems, businesses can significantly reduce manual workload, improve accuracy, and ensure real-time financial reporting. Moreover, these systems often support multiple currencies, enabling cross-border sales and expanding businesses into new markets. Security protocols such as encryption, fraud detection algorithms, and compliance with international payment standards further reinforce trust and reliability in digital payment ecosystems.

Implementation Strategies for Business Success

While the potential benefits of digital payment systems are significant, successful implementation requires careful planning. Businesses must begin by selecting the right payment service provider that aligns with their operational needs and growth objectives. Key considerations include platform scalability, integration capabilities, and customer support services.

Integration with existing financial and CRM systems ensures data synchronization, improving operational efficiency and financial visibility. Employee training is equally critical, as staff must be equipped to manage the new system effectively while troubleshooting customer queries. Establishing a robust customer onboarding process also ensures a seamless user experience, reducing resistance to adopting new payment methods. Moreover, businesses must prioritize cybersecurity measures such as two-factor authentication, data encryption, and real-time fraud monitoring. Compliance with industry regulations such as PCI DSS and GDPR ensures legal and ethical data management, reducing liability risks.

Despite their advantages, digital payment systems come with specific challenges that businesses must anticipate. Security threats such as data breaches and payment fraud remain top concerns. However, advanced fraud detection tools, tokenization, and secure socket layer (SSL) encryption can mitigate these risks.

Regulatory complexities, especially in cross-border transactions, require businesses to stay updated on tax regulations, currency exchange laws, and payment compliance standards. Collaborating with legal experts and payment service providers familiar with global financial regulations can simplify this process. Technical integration challenges can be addressed through modular platforms that support plug-and-play capabilities, enabling businesses to scale their payment infrastructure effortlessly. Resistance from customers accustomed to traditional payment methods is another hurdle. Businesses can overcome this by running targeted user education campaigns highlighting the convenience, security, and rewards of adopting digital payments. Demonstrating real-world benefits through case studies and customer testimonials can further drive adoption.

The Future of Digital Payment Systems

Looking ahead, the digital payment landscape will continue to evolve with innovations such as embedded finance, biometric authentication, and contactless payment technologies. Financial institutions are increasingly partnering with tech firms to create embedded financial products that integrate seamlessly into e-commerce platforms and enterprise systems.

Artificial intelligence and predictive analytics will become central to payment systems, offering personalized payment solutions based on consumer behavior patterns. Blockchain’s potential for decentralized finance (DeFi) platforms will create new avenues for secure and transparent financial transactions, disrupting traditional banking models. With these advancements, businesses that invest in flexible digital payment systems will be well-positioned to capture market share, improve customer experiences, and drive long-term profitability in an increasingly digital economy.