To understand the scope of the transformation, one must first consider the structural complexities inherent in the fuel resale business. Resellers operate in an environment characterized by low margins and high transactional density, where the profit is often captured in the fractions of a cent per liter or gallon. The business model involves the procurement of fuel through multiple card providers or primary suppliers, followed by the secondary distribution of these resources to clients who require specialized billing, credit terms, and consolidated reporting. This creates a data-heavy environment where a single reseller may process tens of thousands of individual transactions per month, each originating from different fuel stations, under varying supplier agreements, and involving different grades of fuel. The logistical challenge is not merely the physical movement of the resource, but the administrative movement of the data associated with it.

The administrative burden is further compounded by the lack of standardization across the energy industry. Primary fuel suppliers and card issuers frequently utilize proprietary data formats—ranging from structured EDI feeds to fragmented CSV and legacy Excel spreadsheets—each with unique headers, unit measurements, and reporting frequencies. For a reseller, the task of "normalization"—the process of converting these disparate data points into a single, cohesive billing system—is the most labor-intensive aspect of the operation. Without a sophisticated digital foundation, this normalization process often falls to human operators, leading to an environment where the speed of business growth is capped by the speed of manual data entry.

Before the strategic intervention and modernization, the subject organization operated under a traditional administrative model that, while functional during its early stages, had become a significant liability as transaction volumes increased. The primary bottleneck resided in the back-end processing systems, which were almost entirely manual and centered on a complex web of interconnected spreadsheets and email communications. Every month, the administrative team was required to aggregate data from three distinct primary suppliers, each providing transaction records in a different file format. This meant that before any invoicing could occur, staff spent days manually cleaning data, reformatting columns, and reconciling individual transactions against client accounts. This manual intervention was not only slow but also created a high probability of human error, which could lead to significant financial leakage or strained client relationships.

The complexity of the legacy system was particularly evident in the application of pricing models. The company utilized "dynamic pricing," where margins were adjusted based on wholesale costs, client contracts, and volume tiers. In the spreadsheet-centric model, these calculations had to be applied line-by-line or through fragile VLOOKUP formulas that were prone to breaking whenever a supplier changed their data structure. This resulted in an invoicing cycle that consumed ten full business days every month. For a standard twenty-day work month, this meant that nearly 50% of the company's administrative capacity was dedicated solely to the retroactive task of billing for past transactions, rather than the proactive task of business development. Furthermore, because the knowledge of these spreadsheet "workarounds" resided with only one or two key staff members, the organization faced a critical single point of failure; should those individuals leave the company, the ability to generate revenue would be effectively paralyzed.

Engineering the Custom Transaction Processing Engine

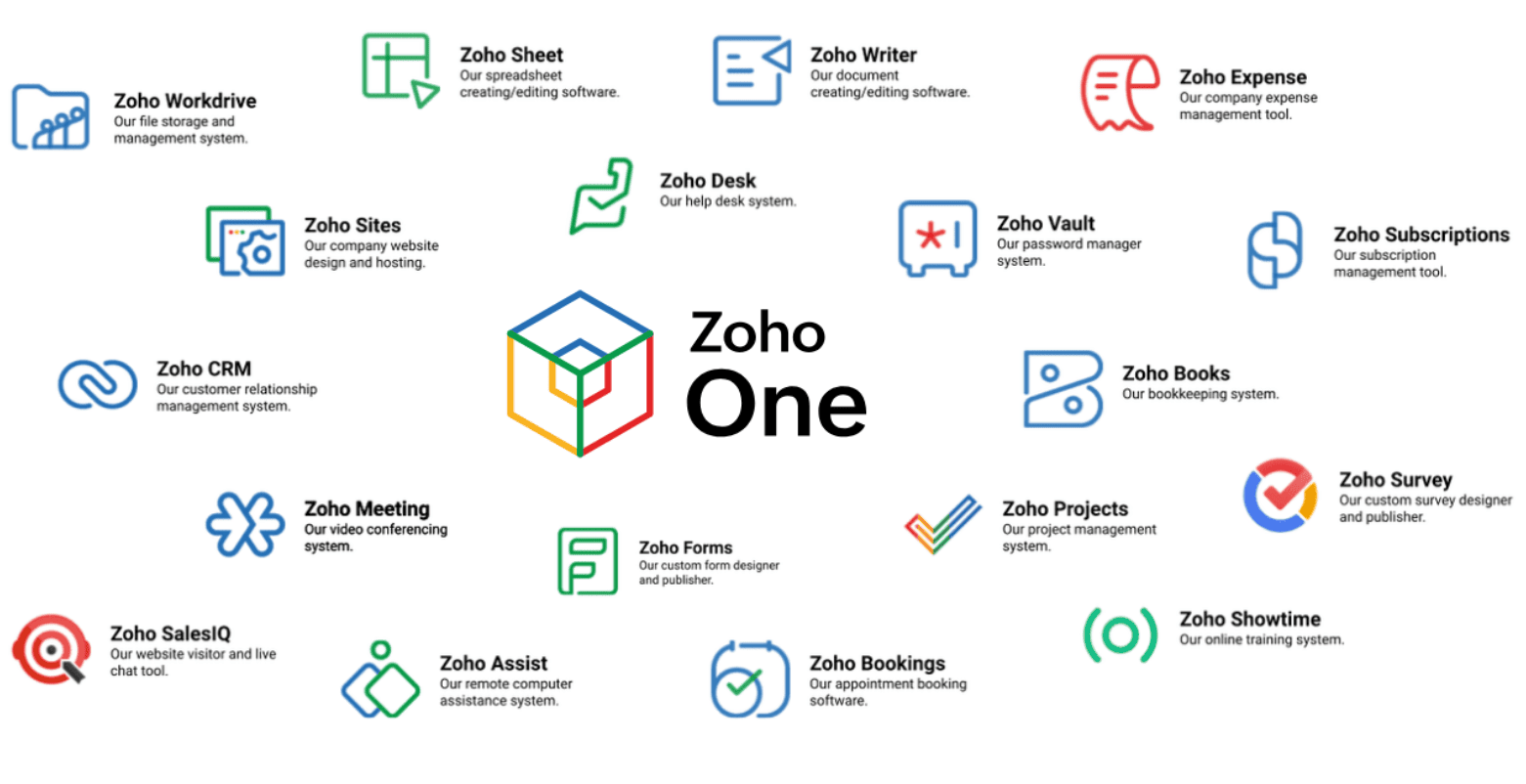

The technical core of the solution involved the development of a proprietary transaction processing engine built within the Zoho One ecosystem, specifically leveraging Zoho CRM and the Zoho Creator low-code platform. This engine was designed to address the primary "pain point" of the business: the heterogeneous nature of supplier data. Erphub engineered a multi-format ingestion layer capable of processing files from all three major suppliers simultaneously. Through the use of Deluge (Zoho’s proprietary scripting language), the engine was programmed to parse the raw data, identify specific fuel card IDs, and automatically associate them with the correct client account in the CRM. This eliminated the need for manual data mapping and reduced the possibility of misallocated charges to zero.

A critical component of this engine was the "Normalization Layer." Because different suppliers reported volume in different units or used different date formats, the engine functioned as a translation tool, converting all incoming data into a standardized internal format. Once standardized, the system applied the dynamic pricing logic in real-time.

Risk Management: Anomaly Detection and "Negative Savings" Flags

One of the most sophisticated features implemented was an automated risk management layer designed to prevent financial loss. In the legacy spreadsheet system, if a supplier's wholesale price spiked or a margin was calculated incorrectly, the error might go unnoticed until after the invoice was paid, resulting in "negative savings" for either the company or the client. Erphub addressed this by building an "Anomaly Detection" module within the Zoho environment. The system was configured to flag any transaction where the calculated margin fell below a predefined threshold or where the data appeared inconsistent with historical patterns.

These flagged records were automatically moved into a "Review Queue" for manual oversight before the invoicing process could proceed. This "exception-based management" model allowed the staff to focus only on the 1% of transactions that required human judgment, rather than the 99% that were routine. This microscopic level of control provided the Managing Director with a new level of confidence in the organization's financial integrity. It transformed the role of the administrative staff from "data entry clerks" to "business analysts," as they now spent their time investigating anomalies and optimizing margins rather than simply moving numbers from one spreadsheet to another.

From Ten Days to Five Hours: The Operational Revolution

The impact of the Zoho One implementation on the organization's efficiency was nothing short of transformative. The most significant metric was the reduction of the invoicing and reporting cycle. In the pre-automation era, the process of gathering data, reconciling transactions, and issuing invoices took ten full business days, a period fraught with stress and potential for error. Post-implementation, the entire cycle was condensed into under five hours. This represents a 98% reduction in time expenditure for the company's core administrative task. The automation of reporting was equally impactful; where previously reports were painstakingly compiled in Excel, the organization now had access to real-time dashboards through Zoho Analytics.

This operational revolution extended beyond just time savings. By utilizing the consolidated billing features of the new system, the company was able to improve its service offering to its corporate clients. Instead of receiving multiple, fragmented invoices for different fuel cards, clients now received a single, professional, and detailed invoice that included a full breakdown of every transaction. This not only improved the professional image of the organization but also reduced the administrative burden on the clients' own accounts payable departments. The use of Zoho Books and Zoho Invoice ensured that the entire financial trail was cloud-based and accessible, allowing for faster payment processing and improved cash flow for the business.

Strategic Outcomes: Scalability and Investor Credibility

Beyond the immediate operational gains, the digital transformation led by Erphub provided the organization with a new level of strategic maturity. By moving away from a personnel-dependent spreadsheet model to a scalable, cloud-based ERP, the business effectively increased its valuation. As the Managing Director noted, the new system added "real credibility" for the future, particularly concerning potential investors or acquirers. An automated, transparent, and auditable financial system is a prerequisite for high-level due diligence, and the Zoho One solution provided exactly that. The business was no longer limited by its administrative capacity; it could now double or triple its client base without needing to significantly increase its back-office headcount.

The transition also facilitated a shift in company culture. With the burden of manual data entry removed, the team was free to focus on strategic growth and client relationship management. The data that was once locked in static spreadsheets became a live asset, providing insights into purchasing trends, supplier performance, and market fluctuations. This "data-driven" approach allowed the organization to negotiate better terms with its own suppliers and identify more profitable niche markets. The transformation was not just about saving time, it was about building long-term value and ensuring the business was "future-proofed" against the increasing digital demands of the energy sector.