What is Cloud Accounting Software?

Cloud accounting software is a software-as-a-service (SaaS) solution that allows businesses to easily track and manage their finances. It's often web-based, so it can be accessed online through a browser without installing any software on your computers or devices. Cloud accounting software is considered an “as-a-service” because businesses pay a subscription fee to use the service, much like they would with an online software-as-a-service (SaaS) solution.

Benefits of Cloud Accounting Software

Benefits of Cloud Accounting Software

Cloud accounting software allows businesses to easily track and manage their finances. By moving your accounting activities to the cloud, you can access your financial information from any device, anywhere in the world. This cloud-based technology offers a secure, reliable platform that can help streamline and simplify your accounting, making it easier to understand and analyze your financial data. With cloud accounting software, you can also access powerful features such as automated data entry, real-time analytics, and comprehensive reporting. By unlocking the benefits of cloud accounting software, you can save time, money, and energy – and better manage your finances for the long-term health of your business.

Key features of Cloud Accounting Software

Key features of Cloud Accounting Software

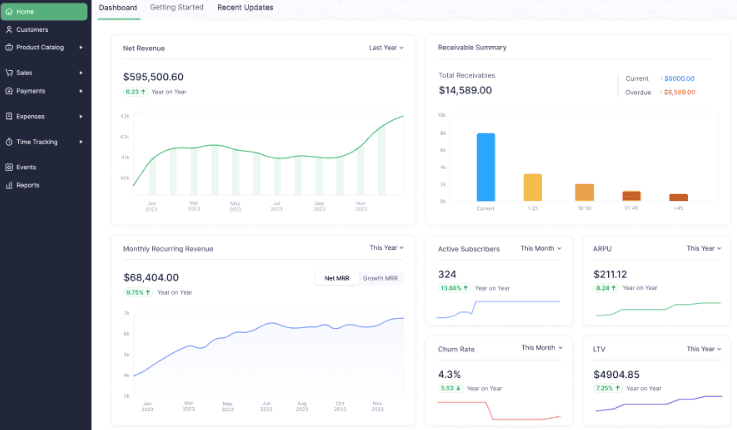

Real-time data: With cloud accounting software, your financial data is always up-to-date and easily accessible, which can help you make better and more timely business decisions.

Automatic data entry: Automatically import your data from various business systems and feed it into your financial reports so you don’t have to manually enter the data yourself

Advanced reporting: Cloud accounting software can provide advanced reports, charts, and graphs that make it easier to understand and analyze your financial data

Multi-user support: Support multi-user functionality, which allows different people to access the same financial information at the same time to help improve collaboration and efficiency

Integrations: Cloud accounting software can offer robust integrations with other tools, such as CRM and HR systems, to help streamline your business processes and simplify your accounting activities.

How to choose the right cloud accounting software

How to choose the right cloud accounting software

Before committing to one cloud accounting software solution, it’s important to consider your business needs and how each solution stacks up. Here are a few things to keep in mind when shopping for a cloud accounting software solution:

1) Ease of use - Choose a cloud accounting software solution that offers a user-friendly, intuitive interface that is easy for you and your employees to navigate and understand.

2) Support and maintenance - Make sure the cloud accounting software solution you choose offers helpful customer support, regular software updates, and reliable service and maintenance plans to ensure the solution is secure, up-to-date, and reliable at all times.

3) Functionality and features - Make sure the cloud accounting software you choose offers the features and functionality you need to effectively manage your business finances.

4) Cost and pricing - The cost and pricing of each solution will vary from one provider to the next, so make sure to select a solution that fits your budget.

Best practices for using cloud accounting software

Best practices for using cloud accounting software

Once you’ve selected and implemented a cloud accounting software solution, there are a few best practices to keep in mind to get the most out of this solution:

- Establish company wide expectations and guidelines - Make sure employees understand the company’s accounting policies and guidelines, including which financial data to track and which data to enter manually. This will help ensure your employees are using the cloud accounting software correctly and effectively.

- Standardize data entry - Standardize the way your employees enter data into the cloud accounting software so they are tracking and recording financial information consistently. This will help drive consistency and efficiency as your company scales.

- Regularly review financial data - Make sure employees are reviewing their financial data regularly so they’re staying on top of their business finances and making informed business decisions.

- Regularly update your company’s financial projections - Make sure employees are regularly updating their company’s financial projections to ensure the cloud accounting software is projecting accurate and up-to-date financial data.

In today's fast-paced business environment, efficiency is paramount. Manual processes, paper-based systems, and outdated accounting software can hinder productivity, create bottlenecks, and lead to costly errors. This is where cloud accounting solutions like Zoho come into play. Zoho offers a suite of powerful applications designed to streamline accounting processes, automate invoicing and billing, ensure compliance, and provide real-time financial insights, empowering businesses to focus on what they do best – growing and thriving. This comprehensive article explores the multifaceted benefits of cloud accounting, automated invoicing, compliance, and billing automation with Zoho, providing a deep dive into its features, use cases, and best practices.

The Rise of Cloud Accounting: Embracing the Digital Transformation

Cloud accounting has revolutionized the way businesses manage their finances. Unlike traditional desktop-based accounting software, cloud accounting solutions like Zoho are hosted on remote servers, accessible from anywhere with an internet connection. This offers numerous advantages:

- Accessibility and Collaboration: Access your financial data from any device, anytime, anywhere. Collaborate with your team and accountants seamlessly, fostering better communication and efficiency.

- Real-time Updates: Get real-time updates on your financial data, ensuring you always have an accurate view of your business's financial health.

- Cost Savings: Eliminate the need for expensive hardware, software licenses, and IT maintenance associated with traditional accounting software.

- Enhanced Security: Cloud providers like Zoho invest heavily in data security, ensuring your financial data is protected with robust security measures.

- Scalability and Flexibility: Cloud accounting solutions can easily scale with your business, adapting to your growing needs and providing the flexibility to add users and features as required.

Zoho: A Comprehensive Suite for Cloud Accounting

Zoho offers a comprehensive suite of cloud-based applications designed to streamline various aspects of accounting and financial management:

- Zoho Books: A user-friendly accounting software that simplifies bookkeeping, invoicing, expense tracking, bank reconciliation, and financial reporting.

- Zoho Invoice: A powerful invoicing solution that enables businesses to create professional invoices, automate billing, and manage customer payments efficiently.

- Zoho Expense: An expense management tool that simplifies expense tracking, automates reimbursements, and provides insights into spending patterns.

- Zoho Inventory: An inventory management system that helps businesses track stock levels, manage purchase orders, and optimize inventory workflows.

- Zoho Subscriptions: A subscription management solution that automates recurring billing, manages customer subscriptions, and provides insights into subscription revenue.

Automated Invoicing with Zoho: Streamlining the Billing Process

Automated invoicing is a game-changer for businesses of all sizes. Zoho Invoice and Zoho Books offer powerful features to automate the invoicing process, saving time and reducing errors:

- Recurring Invoices: Automate recurring invoices for regular customers, ensuring timely billing and consistent cash flow.

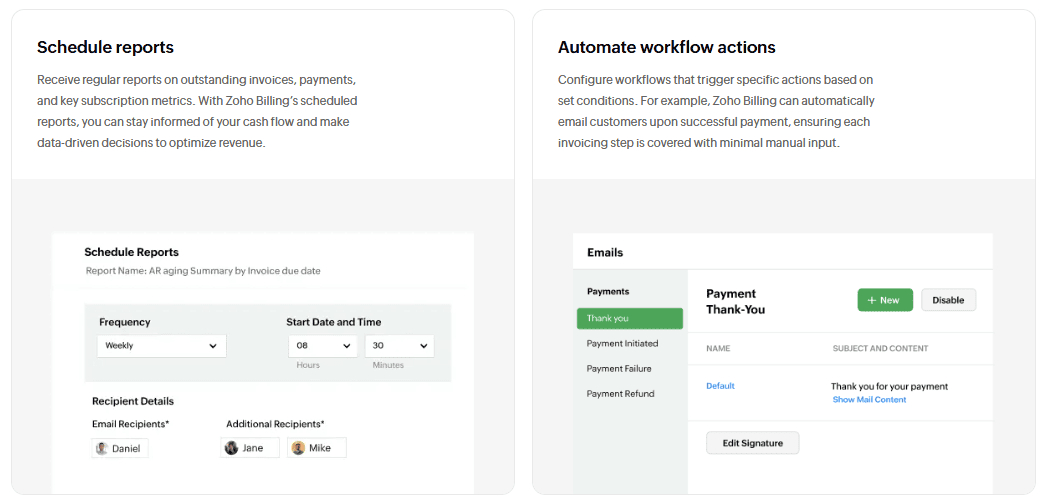

- Automated Payment Reminders: Send automated payment reminders to customers, reducing late payments and improving cash flow.

- Online Payment Integration: Integrate with popular payment gateways like PayPal and Stripe, allowing customers to pay invoices online with ease.

- Customizable Invoice Templates: Create professional invoices with customizable templates that reflect your brand identity.

- Invoice Tracking and Reporting: Track invoice status, payment history, and generate reports to gain insights into your invoicing process.

Compliance Made Easy with Zoho

Staying compliant with tax regulations and accounting standards is crucial for any business. Zoho accounting software helps businesses ensure compliance with ease:

- Tax Compliance: Zoho Books supports various tax regulations, including GST, VAT, and sales tax, ensuring accurate tax calculations and reporting.

- Audit Trails: Zoho maintains detailed audit trails of all transactions, providing transparency and facilitating audits.

- Financial Reporting: Generate accurate and compliant financial reports, including balance sheets, income statements, and cash flow statements.

- Data Security: Zoho complies with industry-standard security protocols, ensuring your financial data is protected and compliant with data privacy regulations.

Billing Automation with Zoho: Enhancing Efficiency and Accuracy

Billing automation is a key component of efficient financial management. Zoho offers tools to automate various aspects of the billing process:

- Automated Invoice Generation: Automatically generate invoices based on sales orders, contracts, or project milestones.

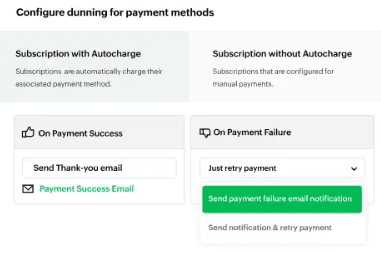

- Recurring Billing: Automate recurring billing for subscription-based services or regular customers.

- Payment Processing: Automate payment processing by integrating with payment gateways and automatically reconciling payments with invoices.

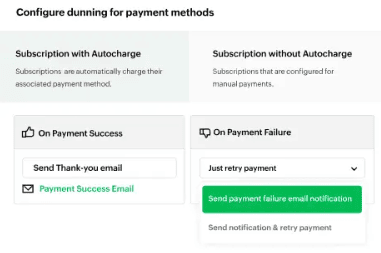

- Dunning Management: Automate dunning emails to remind customers of overdue payments, reducing late payments and improving cash flow.

Zoho accounting solutions are particularly beneficial for small businesses, providing them with the tools they need to manage their finances effectively and drive growth:

- Affordable Solutions: Zoho offers flexible pricing plans to suit the needs and budget of small businesses.

- Ease of Use: Zoho applications are designed with user-friendliness in mind, making them easy to learn and use, even for those without accounting expertise.

- Integration with Zoho CRM: Integrate Zoho Books or Zoho Invoice with Zoho CRM to gain a 360-degree view of your customers and streamline sales and billing processes.

- Inventory Management: Zoho Inventory helps small businesses manage their stock levels, track orders, and optimize inventory workflows.

- Subscription Management: Zoho Subscriptions enables small businesses to manage recurring billing and automate subscription management processes.

Integrating Zoho CRM with Accounting: A Powerful Synergy

Integrating Zoho CRM with Zoho Books or Zoho Invoice creates a powerful synergy that streamlines sales and accounting processes:

- Automated Data Flow: Automatically sync customer data, sales orders, and invoices between CRM and accounting software, eliminating manual data entry and reducing errors.

- Improved Sales Forecasting: Leverage sales data from CRM to generate accurate sales forecasts and improve financial planning.

- Enhanced Customer Insights: Gain a holistic view of your customers, including their purchase history, interactions, and financial data, enabling personalized service and targeted marketing campaigns.

- Streamlined Workflow: Automate workflows between sales and accounting, such as automatically generating invoices when a deal is closed in CRM.

Zoho Inventory for Streamlined Stock Management

Zoho Inventory is a valuable asset for businesses that manage physical goods, providing tools to streamline stock management and optimize inventory workflows:

- Real-time Inventory Tracking: Track stock levels in real-time across multiple locations, ensuring accurate inventory data and minimizing stockouts.

- Order Management: Manage purchase orders, sales orders, and returns efficiently, streamlining the order fulfillment process.

- Barcode Scanning: Use barcode scanning to speed up inventory receiving, picking, and packing processes.

- Multi-channel Inventory Management: Manage inventory across multiple sales channels, including online stores, marketplaces, and physical stores.

Zoho Subscriptions for Recurring Billing

Zoho Subscriptions is a powerful solution for businesses that offer subscription-based services or products, automating recurring billing and providing insights into subscription revenue:

- Automated Recurring Billing: Automate recurring billing for subscriptions, ensuring timely payments and consistent cash flow.

- Subscription Management: Manage customer subscriptions, including upgrades, downgrades, and cancellations, efficiently.

- Payment Gateway Integration: Integrate with popular payment gateways to automate payment processing and reconciliation.

- Subscription Analytics: Gain insights into subscription metrics like churn rate, MRR (Monthly Recurring Revenue), and customer lifetime value.

Conclusion

Conclusion

Cloud accounting software is a software-as-a-service (SaaS) solution that allows businesses to easily track and manage their finances. Cloud accounting, automated invoicing, compliance and billing automation with Zoho offer a powerful combination of tools to streamline financial management, improve efficiency, and drive business growth. By embracing these solutions and implementing best practices, businesses can unlock new levels of productivity, gain valuable financial insights, and focus on what truly matters – achieving their business goals. Cloud accounting software is often web-based, so it can be accessed online through a browser without installing any software on your computers or devices. With cloud accounting software, businesses can track key financial metrics and company KPIs, such as revenue and expenses, more effectively.