Chatbots enhance conversion rates by guiding users through complex transactions or decision-making processes on both web platforms and mobile apps (Mobilisten SDK).

Retail/E-commerce: A Zobot, integrated with a backend inventory system (e.g., Zoho Inventory), can provide real-time product recommendations based on browsing history, handle abandoned cart follow-ups via integrated messaging apps (like WhatsApp/Facebook Messenger), and answer specific product questions (e.g., "Is this shoe available in size 10?"). In specific industries like e-commerce, this dynamic assistance drives conversion improvements up to 30%.

B2B/SaaS: Chatbots automate the crucial step of booking a demo or consultation. A Zobot flow can check the availability of a sales representative using Zoho Calendar integration, book the appointment, and update the CRM, eliminating the friction of email back-and-forth and capturing interest instantly. This immediacy is vital, as 35% of business leaders credit virtual agents for simplifying sales processes and closing deals.

Chatbots enhance conversion rates by guiding users through complex transactions or decision-making processes on both web platforms and mobile apps (Mobilisten SDK).

Retail/E-commerce: A Zobot, integrated with a backend inventory system (e.g., Zoho Inventory), can provide real-time product recommendations based on browsing history, handle abandoned cart follow-ups via integrated messaging apps (like WhatsApp/Facebook Messenger), and answer specific product questions (e.g., "Is this shoe available in size 10?"). In specific industries like e-commerce, this dynamic assistance drives conversion improvements up to 30%.

B2B/SaaS: Chatbots automate the crucial step of booking a demo or consultation. A Zobot flow can check the availability of a sales representative using Zoho Calendar integration, book the appointment, and update the CRM, eliminating the friction of email back-and-forth and capturing interest instantly. This immediacy is vital, as 35% of business leaders credit virtual agents for simplifying sales processes and closing deals.

Strategic Objectives of the Transformation

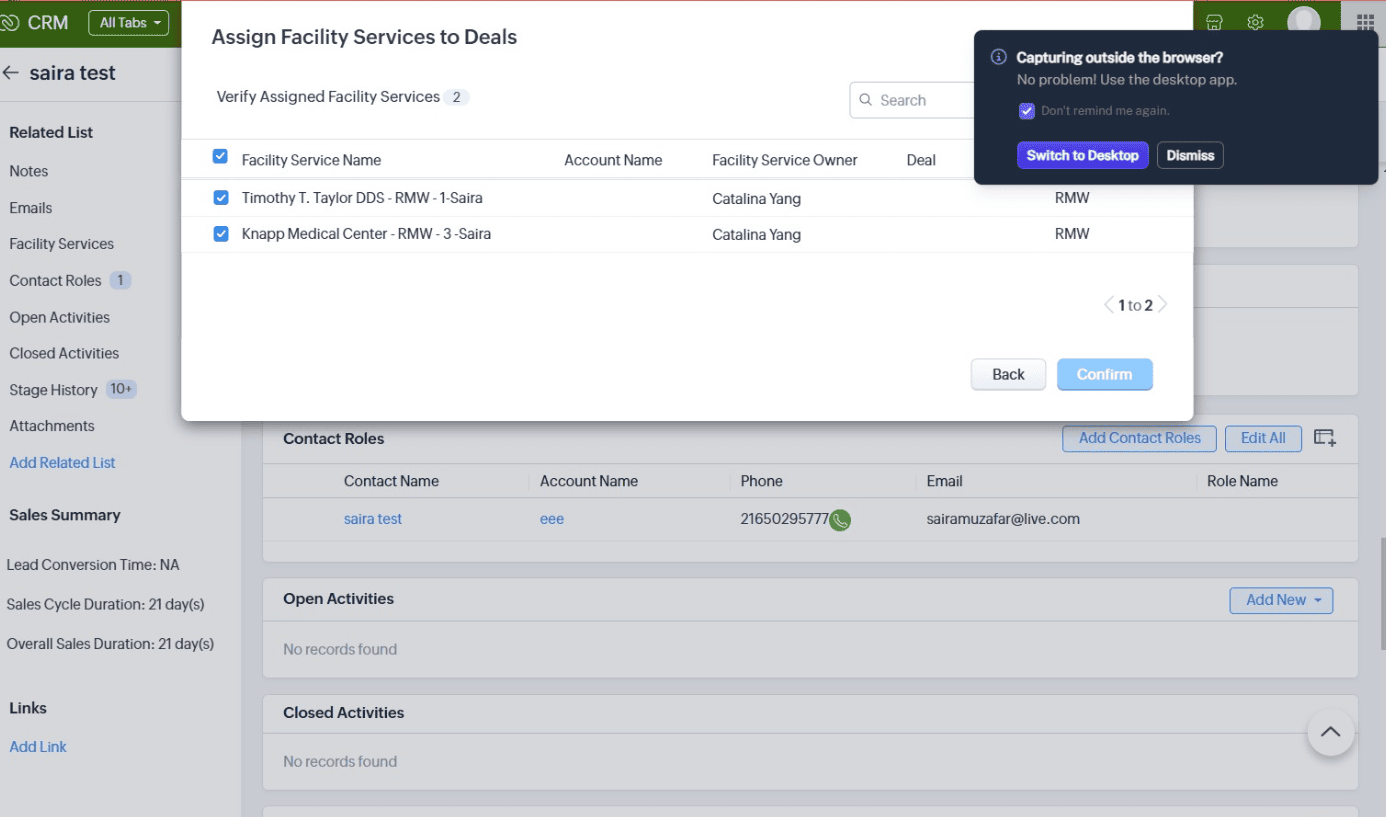

Erphub defined the success of the C2C transformation based on key performance indicators (KPIs) associated with contract management. The project was structured around three overarching strategic objectives:

Efficiency Goal: Minimizing Time to Signature and Sales-to-Invoice Handoff

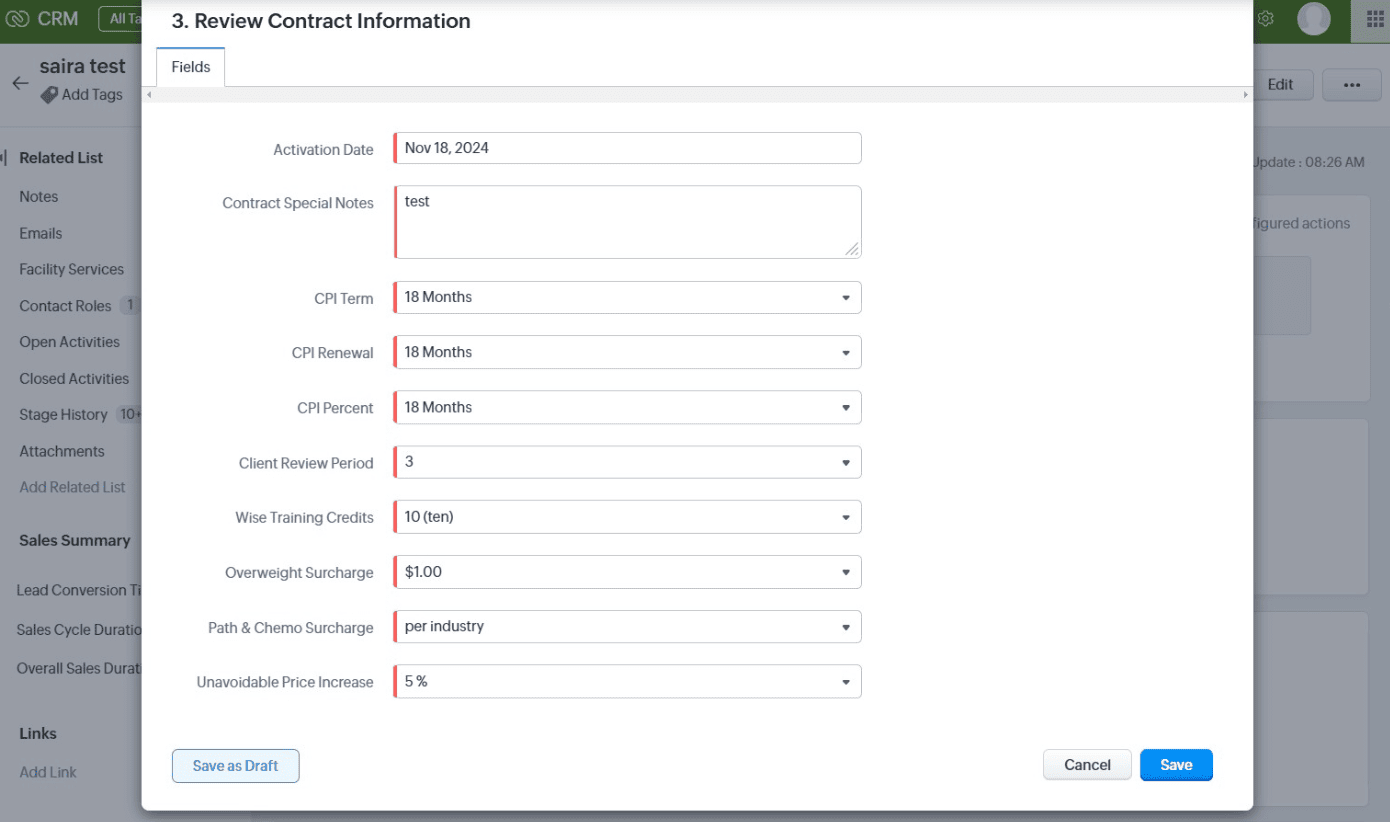

The primary efficiency metric targeted was Contract Cycle Time—the duration from initiation until the contract is fully executed.3 The objective was to implement automated workflows that enabled faster contract authoring through standardized templates, shortened approval cycles via automated reminders, and reduced turnaround times via integrated digital execution.7 The ultimate metric was a radical reduction in the average time spent reviewing, completing, and negotiating each agreement.

Efficacy Goal: Ensuring Contract Value Translation

Contract efficacy measures how well signed agreements translate into business outcomes, particularly accurate sales records and timely revenue. The goal was to eliminate delayed billing and payment friction by ensuring that executed contracts automatically generated accurate invoices and initiated fulfillment workflows. Improving efficacy meant guaranteeing that every executed contract contributed directly to business outcomes, allowing the client to measure performance against service-level agreements (SLAs) and boost renewal success.

Risk Goal: Achieving Maximum Compliance and Version Control

Risk mitigation was addressed through process enforcement. The objective was to eliminate errors associated with outdated contract versions and ensure strict compliance with internal legal standards. This required implementing robust approval workflows and activity logs to enforce legal requirements and utilizing advanced obligation management to mitigate risks from missed contractual obligations.

Auto-Populated Invoicing

The invoices generated via the Zoho Flow workflow were not generic forms but highly accurate, fully auto-populated documents. They contained the precise line items, pricing, tax calculations, and customer billing details pulled directly from the validated Zoho CRM Deal record.30 This level of precision, enforced by the Blueprint validation in Phase One, ensured that invoices were generated flawlessly and instantly, eliminating reconciliation errors and the time previously spent by the Finance team verifying data.

Payment Gateway Integration and Acceleration

A key step in revenue acceleration is minimizing friction at the payment stage. Erphub integrated Zoho Invoice with leading payment gateways, including Stripe and PayPal, among others supported by the platform.

This integration enabled secure online payment collection. By automatically embedding secure payment links directly into the emailed invoice, the client allowed customers to pay immediately via credit card, debit card, or ACH transfer. This capability is fundamental to frictionless payment collection. The immediate conversion from contract execution to electronic payment submission drastically improved the overall cash collection cycle and provided an immediate return on investment for the C2C project.

Post-Contract Operational Synchronization

The conclusion of the C2C cycle involves ensuring continuity for recurring business and initiating highly customized external services.

Managing Recurring Billing

For the client’s subscription services, the integration between Zoho CRM and Zoho Books/Billing was crucial. The initial 'Deal Won' triggered the first invoice, and subsequently, Zoho Books took over the recurring billing schedule. The system established the appropriate contract accounts and automatically triggered set functions for integrated posting of accounting documents. This automation streamlined account maintenance activities, ensuring timely collection and accurate application of credits against new receivables, all linked back to the originating CRM record for a unified audit trail.

Automated Service Provisioning (Zoho Creator)

While Zoho Flow and Projects handled standard fulfillment, some highly customized service offerings required interfacing with third-party client portals or provisioning complex software licenses. For this, Erphub leveraged Zoho Creator, Zoho’s low-code application development platform. Zoho Creator workflows were configured to be triggered either by a final status update in Zoho CRM or by a webhook notification from Zoho Invoice confirming payment receipt. These workflows utilized Zoho Creator’s integration capabilities to interface with external systems and third-party APIs. For example, upon confirmation of payment, a Creator workflow could automatically execute an action to provision a new user account in a client-facing application, or create an entry in an external asset management database. This ensured that the operational process—the final act of providing the service—was completely automated, eliminating the need for internal personnel to manually intervene in service delivery and closing the gap between financial closure and customer activation.

The impact of chatbot solutions on web and app-based engagement is profound, moving the needle on nearly every critical business metric—from sales conversion rates (up to 70% in some sectors) to operational cost reduction (up to 30%). The integrated Zoho ecosystem, through the complementary power of Zoho SalesIQ (for engagement and lead generation) and Zoho Desk (for service and self-resolution), provides the ideal framework for businesses seeking to deploy a sophisticated, multi-dimensional Conversational AI strategy. Erphub's clients can transform their digital properties into perpetually available, hyper-responsive, and personalized engagement hubs. This is the Conversational Revolution—a necessary transformation for any business aiming to thrive in the instant-response economy.