Pillars of a Modern Financial Engine

The term "streamlined accounting" transcends simple organization or basic software usage. It represents a fundamental re-architecting of a company's financial operations, built upon a set of interconnected strategic pillars. For a business owner, understanding these pillars is the first step toward envisioning a finance function that works for the business, not just in it. A truly streamlined system is not merely about doing the old things faster; it is about enabling new capabilities that drive growth, mitigate risk, and provide profound strategic clarity.

Pillar 1: Intelligent Automation. At its core, streamlined accounting seeks to automate every possible routine and repetitive task. This extends far beyond simple calculations. It involves the automated generation and delivery of invoices based on project milestones or subscription cycles, the automated categorization of expenses through intelligent receipt scanning, the automated chasing of overdue payments through pre-defined dunning workflows, and the automated reconciliation of bank transactions against accounting records. The goal of automation, as frequently discussed in analyses by firms like McKinsey & Company, is not to replace human oversight but to liberate it. By automating the mundane, finance professionals can elevate their role to focus on exception handling, financial analysis, and strategic advisory, where their expertise adds the most value.

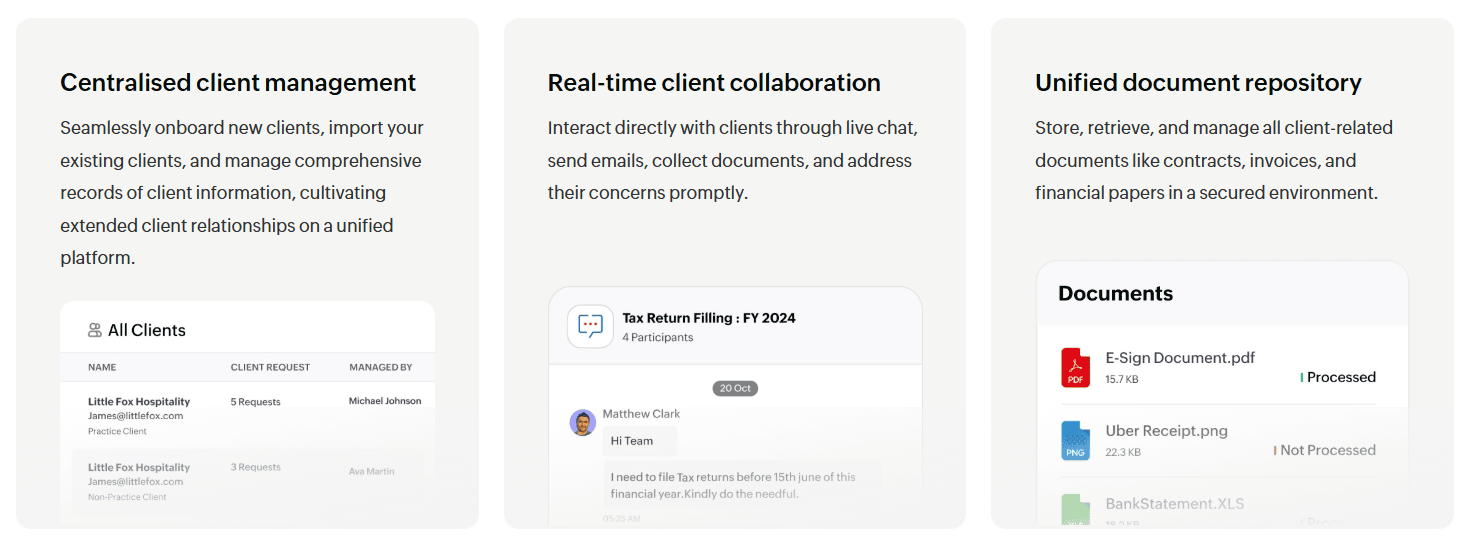

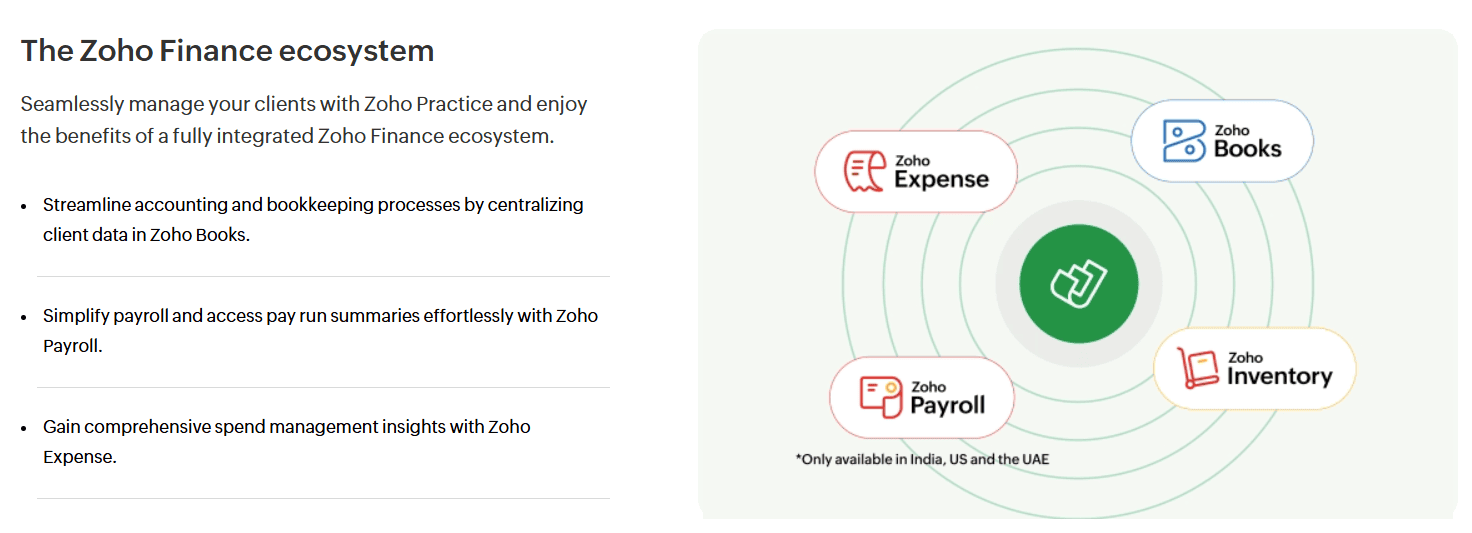

Pillar 2: Seamless Integration. This pillar addresses the critical problem of data silos. A streamlined accounting system does not exist in a vacuum. It must be seamlessly integrated with all other operational facets of the business. The accounting platform should natively communicate with the Customer Relationship Management (CRM) system, ensuring that sales data flows directly into invoicing and revenue recognition. It must connect with inventory management systems to provide a real-time reflection of assets and cost of goods sold (COGS). It should integrate with expense management tools, project management platforms, and payment gateways. This deep integration creates a single source of truth for all financial and operational data, eliminating the need for manual data transfer, reducing errors, and providing a holistic, 360-degree view of the business in real time.

Pillar 3: Real-Time Visibility and Accessibility. The era of waiting for month-end reports to understand a company's financial position is over. A modern, streamlined system is cloud-based, providing secure, real-time access to financial data from anywhere, on any device. This means a business owner can view a real-time cash flow statement, check the status of accounts receivable, or approve an expense report from their phone while traveling. This pillar is about empowering decision-makers with up-to-the-minute information. Dashboards should provide an at-a-glance view of Key Performance Indicators (KPIs) like revenue, expenses, profit margins, and cash burn rate, transforming the accounting system from a historical record into a dynamic, forward-looking business intelligence tool.

Pillar 4: Proactive Compliance and Robust Security. Streamlining is not just about speed; it's about control and security. An advanced accounting system should have built-in features that simplify compliance and harden security. This includes maintaining a detailed, unalterable audit trail of every transaction, automating sales tax calculations based on jurisdiction, and simplifying the generation of reports needed for tax filing and financial audits. On the security front, it involves robust user access controls, data encryption both at rest and in transit, and adherence to international security standards to protect sensitive financial information from both internal and external threats.

Pillar 5: Inherent Scalability. A streamlined accounting solution must be able to grow with the business without requiring a costly and disruptive "rip-and-replace" overhaul. As the company expands into new markets, adds new product lines, or increases its transaction volume, the accounting system should scale effortlessly. This means supporting multi-currency transactions, managing financials for multiple business entities or branches under one umbrella, handling a growing number of users, and adapting to more complex revenue recognition and reporting requirements as the business matures.

Achieving these five pillars requires a platform that is inherently automated, integrated, accessible, secure, and scalable. The Zoho ecosystem, with Zoho Books at its core, is specifically designed to deliver on these principles, providing businesses with a powerful engine to build their modern financial command center. The expert implementation of such a system, guided by a partner like Erphub, ensures that these pillars are not just abstract concepts but a concrete operational reality.

Zoho's Integrated Finance Suite

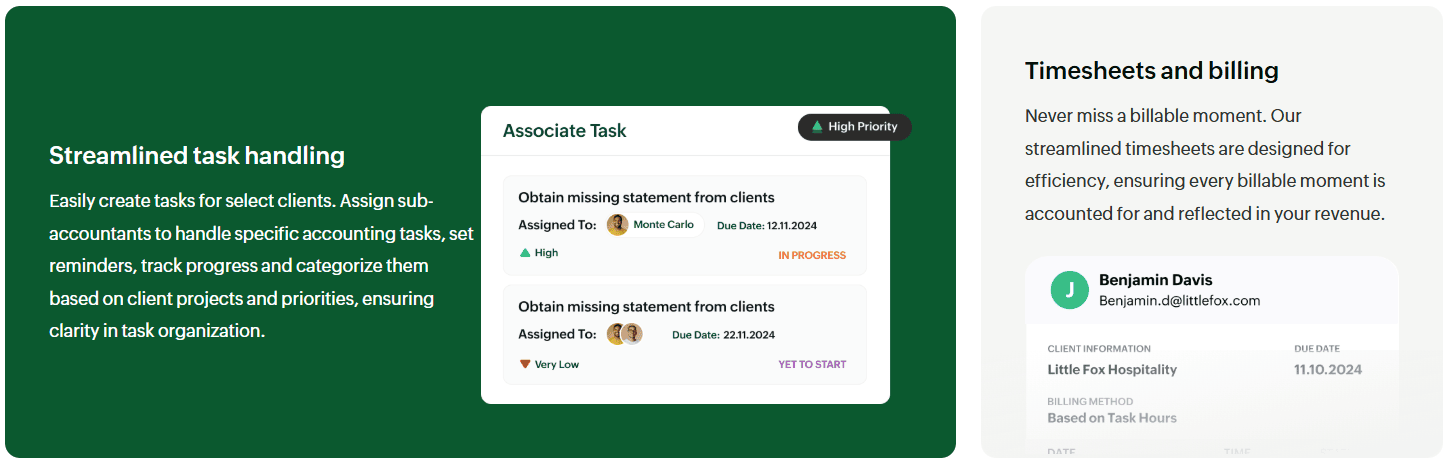

To move from the theory of streamlined accounting to its practical implementation, businesses need a technology stack that is both powerful in its individual components and synergistic in its integration. The Zoho Finance Suite, often leveraged as part of the all-encompassing Zoho One platform, represents such an engine. With Zoho Books serving as the central accounting hub, the suite integrates seamlessly with specialized applications like Zoho Expense and Zoho Inventory, creating a unified system that addresses the core pillars of modern financial management. This section provides a deep, multi-dimensional exploration of these key Zoho applications, focusing not just on their features, but on the transformative business value they deliver.

3.1. Zoho Books: The Central Hub for Your Financial Universe

Zoho Books is a comprehensive, cloud-based accounting platform that forms the heart of Zoho's financial ecosystem. It is designed to manage the entire financial lifecycle of a business, from day-to-day transactions to high-level financial reporting, with a profound emphasis on automation and integration.

3.1.1. Automating the Core: Accounts Receivable (A/R) and Accounts Payable (A/P)

The management of money coming in (A/R) and money going out (A/P) represents a significant portion of any accounting team's workload. Zoho Books is engineered to automate these critical flows, dramatically reducing manual effort and accelerating cash flow.

Automated Accounts Receivable: The platform transforms the process of getting paid. Instead of manually creating and emailing invoices, users can set up recurring invoice profiles for subscription-based clients or automatically generate invoices from approved estimates, sales orders, or even logged time in Zoho Projects. These professional, customizable invoices can be sent automatically via email, and the system can be configured to send a series of automated, polite payment reminders for overdue invoices, taking the tedious and often uncomfortable task of chasing payments off your team's plate. This systematic dunning process is proven to reduce the average collection period and improve cash flow. Furthermore, integration with multiple online payment gateways (like Stripe, PayPal, and others) allows clients to pay directly from the invoice with a click, further reducing payment friction.

Automated Accounts Payable: Managing vendor bills and payments is streamlined with equal elegance. Vendor bills can be entered into the system, with options to upload the source document for a complete digital record. Zoho Books helps manage payment due dates, and businesses can set up approval workflows, ensuring that bills are reviewed and approved by the appropriate manager before payment is processed. The system can then facilitate payments directly via ACH or other methods, and it automatically records the transaction, closing the loop on the A/P cycle. For businesses with recurring vendor bills, such as monthly software subscriptions or rent, recurring bill profiles can be created to automate the entry process, ensuring expenses are always recorded on time.

3.1.2. Intelligent Banking and Reconciliation

The dreaded month-end bank reconciliation process is one of the most significant time sinks in traditional accounting. Zoho Books tackles this with intelligent automation. Businesses can securely connect their bank and credit card accounts, allowing feeds of all transactions to flow directly into the accounting platform in real time. Zoho's system then uses transaction rules and machine learning to automatically categorize these transactions based on historical data. For example, it will learn that a transaction from "Uber" is typically categorized as "Travel Expense." This leaves the accounting team to simply review and confirm the suggested categorizations, rather than manually entering and coding hundreds or thousands of transactions. This feature alone can reduce the time spent on reconciliation from days to mere hours, providing a more current and accurate view of the company's cash position at all times.

3.1.3. Comprehensive Sales and Purchase Order Management

For businesses that deal with physical goods or complex service agreements, the process starts long before an invoice is sent. Zoho Books includes robust modules for managing the entire sales and purchase lifecycle. Sales teams can create and send professional estimates to clients. Once approved, these estimates can be converted into a sales order with a single click, which can then trigger processes in Zoho Inventory (if applicable) to reserve stock. Finally, the sales order is converted into an invoice once the goods are shipped or services are rendered. A similar, mirrored process exists on the purchasing side, allowing businesses to issue purchase orders to vendors, track the receipt of goods, and convert the PO into a bill for payment. This end-to-end tracking provides complete visibility and control over the entire order-to-cash and procure-to-pay cycles.

3.2. Zoho Expense: Taming the Chaos of Expense Reporting

Expense management is a notorious pain point for businesses, often involving lost receipts, out-of-policy spending, and a slow, frustrating reimbursement process. Zoho Expense is a dedicated application that integrates seamlessly with Zoho Books to automate and control the entire expense reporting lifecycle.

Employees can capture receipts on the go using their smartphone camera; Zoho Expense's OCR (Optical Character Recognition) technology automatically scans the receipt and creates an expense entry, extracting key details like the vendor, date, and amount. Businesses can build and enforce comprehensive expense policies within the application—for example, setting spending limits for specific categories like meals or airfare. The system will automatically flag any out-of-policy expenses for review. Employees can then group these expenses into reports and submit them for approval through a multi-level, automated workflow. Once a report is approved, the reimbursement process can be initiated, and all the approved expense data, correctly categorized, flows directly into Zoho Books, eliminating the need for any manual data entry by the accounting team. This creates a fast, compliant, and transparent expense management process for the entire organization.

3.3. Zoho Inventory: Synchronizing Sales, Stock, and Accounting

For any business that buys, sells, or manages physical goods, from e-commerce retailers to manufacturers and distributors, inventory is a critical asset, and its management is deeply intertwined with financial accounting. Zoho Inventory provides a powerful platform for managing stock levels, orders, and warehouses, and its real-time, two-way sync with Zoho Books is a cornerstone of a streamlined financial system for product-based businesses.

When a sales order is created in Zoho Books or a sale is made through an integrated e-commerce platform (like Shopify or Amazon), Zoho Inventory automatically updates stock levels. When goods are received from a supplier against a purchase order, inventory quantities are increased. This ensures that sales and purchasing teams always have an accurate view of what's in stock. From a financial perspective, this integration is even more critical. Zoho Inventory uses the FIFO or Weighted Average costing method to track the value of inventory. When an item is sold, it automatically calculates the Cost of Goods Sold (COGS) and records the corresponding journal entry in Zoho Books. This ensures that the balance sheet (which reflects the value of inventory on hand) and the profit and loss statement (which includes COGS) are always accurate and up-to-date. The platform also supports managing multiple warehouses, tracking serialized or batch-tracked items, and generating insightful stock aging and valuation reports, providing complete control over a company's largest asset.

Together, Zoho Books, Zoho Expense, and Zoho Inventory form a tightly integrated core that automates transactions, eliminates data silos, and provides a real-time, accurate foundation for financial management. For a US business owner, implementing this suite under the expert guidance of a partner like Erphub means replacing financial chaos with operational clarity and strategic control.

From Bookkeeping to Business Intelligence

A truly advanced accounting system does not merely record history; it illuminates the path forward. Once the foundational pillars of automated and integrated accounting are established with Zoho Books, Expense, and Inventory, the next frontier is transforming that rich transactional data into actionable business intelligence. This is where the broader Zoho ecosystem, particularly Zoho Analytics, elevates the finance function from a back-office necessity to a strategic nerve center for the entire organization. This evolution is about moving from "what happened" to "why it happened" and, most importantly, "what is likely to happen next?".

4.1. Zoho Analytics: The Command Center for Financial Intelligence: Zoho Analytics is a powerful self-service business intelligence and data analytics platform that integrates deeply with the entire Zoho suite. It automatically syncs data from Zoho Books and other apps, allowing business owners to create highly customized, interactive dashboards and reports that go far beyond standard financial statements.

- Comprehensive KPI Dashboards: Visualize critical metrics in real time: Gross and Net Profit Margins, Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), Days Sales Outstanding (DSO), Cash Conversion Cycle, and many more.

- Profitability Analysis: Drill down into profitability by product line, service, customer, or project to understand what truly drives the bottom line.

- Cash Flow Forecasting: By analyzing historical trends in receivables, payables, and operational expenses, Zoho Analytics can help generate more accurate cash flow projections, enabling proactive cash management.

- "What-If" Analysis: Business owners can model the potential financial impact of strategic decisions, such as a price change or a new marketing investment, before committing resources.

4.2. Ensuring Proactive Compliance and Audit Readiness: An advanced system simplifies the complex world of compliance.

- Automated Audit Trails: Zoho Books maintains an immutable log of every single transaction—who created it, who approved it, who edited it, and when. This provides a transparent and complete audit trail that is invaluable during financial audits or internal reviews.

- Simplified Tax Compliance: The platform automates sales tax calculations based on the customer's location and the product/service's taxability. It generates reports (like the Sales Tax Liability report) that make state and federal tax filing significantly simpler and more accurate. For businesses operating globally, it can handle different tax regimes like GST or VAT.

- Financial Reporting Standards: The system is built to adhere to standard accounting principles (GAAP), ensuring that financial statements like the Balance Sheet, P&L, and Statement of Cash Flows are generated correctly.

4.3. Fortifying Financial Security with Robust Controls: Data security is non-negotiable in financial management.

- Role-Based Access Control: Zoho allows business owners to define granular user permissions, ensuring that employees can only access the specific financial data and functions relevant to their roles. For example, a salesperson might be able to create estimates but not approve bills, while a junior accountant might be able to categorize transactions but not process payments.

- Data Encryption and Platform Security: Zoho invests heavily in securing its cloud infrastructure, employing end-to-end encryption for data in transit and encryption at rest for data stored on its servers. They maintain compliance with leading international security standards, providing enterprise-grade security for businesses of all sizes.

By leveraging these advanced capabilities, businesses can transform their accounting data into a strategic asset. It enables a forward-looking, data-driven culture where decisions are made with confidence, based on real-time intelligence and insightful analysis. Erphub specializes in helping businesses configure and customize these advanced analytical and control features to provide the specific insights they need to drive growth and manage risk.

From Bookkeeping to Business Intelligence

Affiliate marketing has matured into a highly effective and scalable channel for customer acquisition and revenue generation. Businesses partner with affiliates (individuals or other companies) who promote their products or services in exchange for a commission on sales or leads generated.

- Low Upfront Cost: It's a performance-based model; you only pay for actual results, making it highly cost-effective compared to traditional advertising.

- Broadened Reach: Affiliates can tap into niche audiences and markets that a business might not reach directly.

- Credibility and Trust: Recommendations from trusted affiliates can carry more weight than direct advertising.

- Measurable ROI: With proper tracking, the return on investment from affiliate marketing is highly measurable.

The global affiliate marketing industry is valued in the tens of billions of dollars and continues to grow, as highlighted by industry resources like Affiliate Summit and various market research reports. Effective management of affiliate programs, from tracking referrals to calculating and disbursing commissions, is crucial for success and requires robust systems.

Strategic Implementation

Implementing a comprehensive financial system like the Zoho suite is a significant strategic project. A haphazard approach can lead to poor user adoption, data integrity issues, and a failure to realize the platform's full potential. A structured, phased implementation, guided by an expert partner like Erphub, is the key to a successful transformation.

- Phase 1: Discovery and Strategic Planning: This foundational phase involves a deep dive into the business's current processes, pain points, and strategic goals. It's about mapping existing workflows and designing optimized future-state processes that leverage Zoho's capabilities. This is where a detailed project roadmap, timeline, and success metrics are established.

- Phase 2: System Configuration and Customization: This is the core technical setup. It involves configuring the chart of accounts in Zoho Books, setting up tax rates, customizing invoice and estimate templates, building approval workflows in Zoho Expense, and tailoring the system to the unique logic of the business.

- Phase 3: Data Migration: Carefully and accurately migrating historical financial data from legacy systems (like QuickBooks, Xero, or spreadsheets) into Zoho is critical for continuity and accurate year-over-year reporting. This process requires meticulous planning and validation.

- Phase 4: Integration: Setting up and testing the seamless integration between Zoho Books and other critical systems, including Zoho CRM, Zoho Inventory, payment gateways, and any necessary third-party applications.

- Phase 5: User Training and Go-Live: Training the finance team, sales team, and management on how to use the new system effectively is crucial for adoption. This is followed by a carefully planned go-live, often with the expert partner providing "hypercare" support during the initial transition period.

- Phase 6: Continuous Optimization: A successful implementation doesn't end at go-live. It involves ongoing partnership to monitor performance, refine workflows, provide ongoing support, and leverage new Zoho features as they are released to ensure the system continues to evolve with the business.

For a US business owner, navigating this process alone is fraught with risk. Erphub, as a certified Zoho partner, brings indispensable value at every stage. We translate your business needs into a technical blueprint, apply best practices from hundreds of implementations, manage the complexities of data migration and integration, provide tailored user training, and offer ongoing strategic guidance to ensure you achieve maximum ROI from your Zoho investment. Partnering with an expert transforms a software implementation into a successful business transformation.